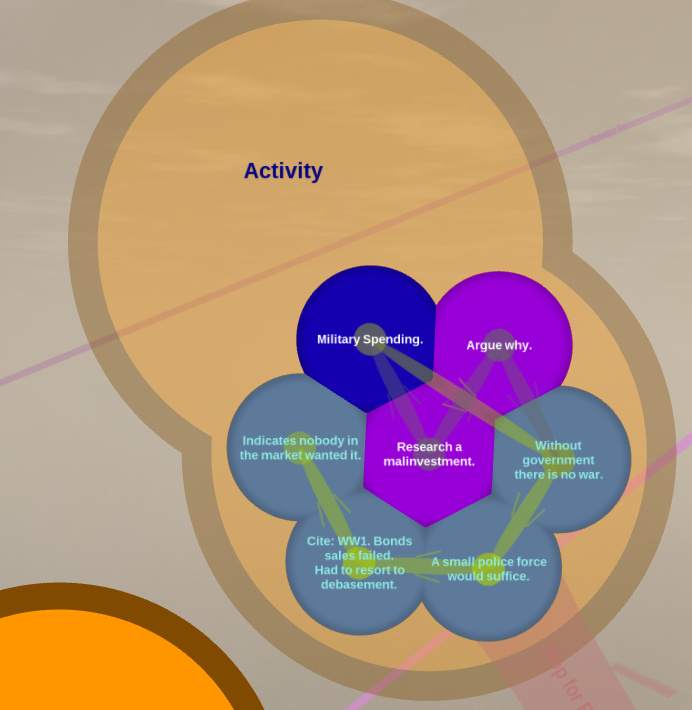

Research an investment (could be a public company, private company, government agency, infrastructure project, etc) that you believe meets the definition of a malinvestment (past or present) and argue why you think it’s a misallocation of capital (3-5 sentences).

US Treasury Bonds. Take a look at this link: https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx?data=yieldYear&year=2020

The interest rates are tiny! (when compared to hard money: Gold, Silver, Bitcoin) These aren’t investments, the US Government paid me a higher percentage of my salary this year in a stimulus check!

While revered by many financial advisors as a safe haven, with hyperinflation looming, it is easy to see US Treasury Bonds as a malinvestment.

Great question - wow where to start?

I’ve been an avid fan of Danielle DiMartino Booth (author of “Fed Up”) for a while so I’d have to argue that the US Fed buying up corporate debt is definitely one of the largest misallocation of capital in the history of the US.

Ironically they’re providing liquidity to zombie companies that are not providing any significant productivity output to the US economy, in doing so trying to solve a solvency problem with short term liquidity. These companies are yet another deflationary force that the FED is trying so hard to prevent, yet they’re exacerbating the problem without realizing what they’re doing!

I’d be careful to come out with a statement that “hyperinflation” is looming. Inflation/deflation is an incredibly complex topic that no -one really knows the answer too - remember also that, just because the Fed is printing doesn’t necessarily mean there will be hyperinflation soon. Money velocity includes both the available money in the system AND the willingness of the consumer to spend it. If the consumer loses their job / faces an economic shock and decides to save rather than spend, this is deflationary and no matter how much money the Fed prints and gives consumers, inflation will not rear its ugly head.

Pets.com began as an online store for pet supplies etc in late 1998. There business plan was terrible and they not only overspent on huge marketing campaigns to an audience that had very little familiarity with online shopping nor even capable of it, they sold products at fractions of what it cost them to obtain, losing money on practically every sale they made.

Nonetheless investors threw 10’s of millions of dollars at the company. They IPO’d in 2000 a little over a year after launching and raised over $87 million with a stock price at about $11.00. Within a year their stock had fallen to $0.11 and they went out of business.

The easy money of the early internet bubble led to the malinvestment into pets.com. and its one of the topmost classic examples of malinvestment.

I think a great example would be Deutsche Bank (or Goldman Sachs historically speaking) for the very reasons described in these lectures. In short, banks, and sometimes even huge corporations, often invest recklessly and then await a bailout from taxpayer’s money when things go sour. In some sense, they are incentivized to act this way when they can create money from lending in the case of banks or when they can lobby the government claiming the amount of lost jobs would be negatively reflected on the politicians’ mandates. In some sense, those investments into failed leadership of institutions is already forced through inflation or taxes. Since it clearly doesn’t work in the long run, why throwing in extra money?

One example that always comes to mind is that of the Enron scandal where they used trickery (SPV - special purpose vehicles) to hide enormous mountains of debt and toxic assets from investors. The stock dumped from $90/share to almost $0.25.

This event is what ushered in the Sarbanes-Oxley act.

I have no idea how governments are spending money in other country but in Germany there are always big problems when the state wants to build something.

Some examples: Berliner airport, Stuttgart 21, Elbphilharmonie in Hamburg. Costs are exploding and the time for building it took way longer than “expected”.

But a really nice example are also submarines which should be the newest and best on the world.

They were regarded as the most modern and innovative thing NATO currently had to offer: the six submarines of the German Navy. They are powered by fuel cells and this had its price. They cost the German taxpayer three billion euros. And whats the problem? In an emergency they will probably not be of much use. None of the submarines should be even remotely operational!

They should only be used for test or training runs, and they are constantly being repaired in shipyards. A boat that has been in service for 13 years has only once undergone a major mission. Otherwise the boats lie around unused most of the time and/or wait for spare parts.

No wonder that this also affects the submarine crew. So there should be only three commanders for the seven submarine crews.

XRP. They dump their own coins on the market, decreasing the value. The chart obviously shows lower lows and lower highs. It only pumps when the market is euphoric, not because of the fundamentals, but because of hype.

Singapore Airlines receive aid from the government’s Resilience Budget to the tune of up to S$17B, because the airlines bank accounts will not be enough to tide the company over the months to come – due to covid19.

Air travel is a luxury, and aiding a luxury business seems like an extravagant international economy option to me. That bailout could have been used towards generating or sustaining more jobs and local businesses within the immediate local economy, which is the backbone of the nation.

If SIA bankrupts, as it is expected to due to flight shutdowns and its reported bank reserves, talented staff leaving the company could potentially flood the market and trigger a wave of unprecedented new businesses or industries, especially with the introduction of grants (which the S$17B could have been offered for).

The Petro almost a combination of all 4 of those types but at the end of the day was essentially vaporware. Originally was “backed” by oil, gas, diamonds, which was merely a statement by Maduro and no facts or sources to back up those claims. In fact the opposition party all but confirmed it a malinvestment by definition with the statement “declared the petro to be an illegal debt issuance by a government desperate for cash, and has said it will not recognize it”

Any capital investment would quickly lose all its value as there is nothing underpinning it, and you cannot actually redeem Petro for oil or any other resource. It also is just a copy paste of dash at best so it has no unique usecase value.

How much capital in this future business is from ‘private sources’ capital? Investments abroad make me think of all countries that have printers making Brbrbrbrbr and then ‘government firms’ doing spending of the ‘red printed currency’ overseas … after long years paying cheap goods from there now it is time to ‘pay’ them back accepting their becoming owners of what is still left to sell.

https://www.forumchinaplp.org.mo/huawei-eyes-portugals-second-solar-auction/

An example from the passed… EU pays Portugal to close one of its most important industries, the fishing industry was almost decimated with this malinvestment to Portugal done/forced by the EU in the 90’s:

And an example of a malinvestment for the Banks in Portugal, due to passed negative EURIBOR rates, the Portuguese government ruled Banks to pay back their customers for their housing/real-estate mortgages

Thhe Real Estate Crash of 2007- 2008 is a perfect example of malinvestment. Low interest rates and an expanding money supply allowed banks to practically give away money via NINJA Loans (No Income No Job) and other ways. This bubble bursted after being pumped up for so long

I am living in Spain and an excellent example would be the “public” (government run) health system. It is run by bureaucrats who decide everything. People get free services but at the same time the system is completely inefficient because the bureaucracy doesn’t allow to react quickly to the real needs. The medicines that are bought by the system are overpriced because there is no market competition.

Malinvestment: easy access to large amounts of government backed student loans are a primary cause of rising tuition costs.

- Supply of higher education has not significantly increased, but easily available funding has increased demand

- More money chasing the same amount of services drives up the price

- Private funding sources expect a return on their investment so would be more diligent in funding studies that have a good chance of producing graduates than can repay the loans

This headline from CNET summarizes a malinvestment in reverse and boardroom thinking that made blockbuster a malivestment.

Blockbuster had a chance to “10x” shareholders profits and its market share if it just had better vision.

Sadly It chose not to invest in Netflix.

In this, the age of information to not be on the lookout for technological innovations in ones industry is a death sentence.

Blockbuster stores closed nationwide and well we know how that story ended

Here in the UK, just over a decade ago, the government was persuaded by an economist to give enormous sums of money to behaviourist psychologists on the promise that this cash injection would result in greater happiness and productivity. Their thinking was that people were not working because they were not happy and that if they were taught how to think correctly about their situation, then they would return to their jobs productive and happy. No attempt was made to understand the complex social problems and because the money was ‘free’ no effort was made to consider alternatives. Distorted metrics were used to ‘prove’ that the project was working. It continues still, even though the cash is running out and no one with actual knowledge of the picture behind the data believes it is effective.

The housing bubble in 2008 is a great example. The banks manipulated the ratings of packages of bad mortgages (meaning the once which were provided to people about who they could anticipate that they wont be able to pay it back) to be able to get rid of them by selling them to the other banks.

A good example of malinvestment for me would be the investment into Myspace just before the rise of other social networks like Facebook, Twitter and Instagram.