- Research and find out local fintech regulations in your region.

- Make a screening of RegTech fintechs in your region.

What will be interesting to see is the intersection of MiFID and MiCA. They construct MiCA because traditional financial regulation might not be applicable for crypto assets. There is already the push of amending MiFID to make their definition for financial instruments technology-neutral, meaning that a security could be legally tokenized using DLT and fall under MiFID.

MiCA aims to be only applicable if other regulation are not applicable. So the intersection, once the traditional financial regulation got amended, will be interesting to see!

As per EU directives the Bank of Italy has implemented the Fintech Hub (a technology common platform) and the ‘regulatory sandbox’, a list of rules that fintech companies should follow. These enclose the protection of personal data, the immediate need to communicate any event of cyber attack for eventual common protection, and new rules about money laundering. The crypto currencies financial service remains without any specific rule; at current state they are considered like foreign currencies and there are not specific requirements to operate with them.

Source https://bebeez.it/2020/09/07/fintech-tutte-le-nuove-regole-in-arrivo/

US Market:

https://iclg.com/practice-areas/fintech-laws-and-regulations/usa

https://www.globallegalinsights.com/practice-areas/fintech-laws-and-regulations/usa

https://www.dashdevs.com/fintech/

On Dec 2nd, 2020 Massachusetts Congressman Lynch along with 2 other lawmakers had introduced the Stable Act to ban Alt Coins in US.

It is not really a local regulation, but a local lawmaker is pushing for it.

https://coinmarketcap.com/headlines/news/us-regulation-stablecoin-act-crypto-twitter-not-happy/

A BItlicense is a regulation required by New York state for any person or business that engages in Virtual Currency Business Activity.

Virtual Currency Business Activity can fall into one of five types of activities involving New York or New Yorkers:

- receiving Virtual Currency for transmission or transmitting Virtual Currency;

- storing, holding, or maintaining custody or control of Virtual Currency on behalf of others;

- buying and selling Virtual Currency as a customer business;

- performing exchange services as a customer business; or

- controlling, administering, or issuing a Virtual Currency.

1 ) Here is the 2019 report on fintech regulations in Canadahttps://www.mccarthy.ca/en/insights/blogs/techlex/fintech-regulatory-developments-2019-year-review.

Regulatory comparaison

Canadahttps://www.mondaq.com/canada/technology/875882/fintech-comparative-guide

2 ) There are manu Regtech companies in every sector of Fintec

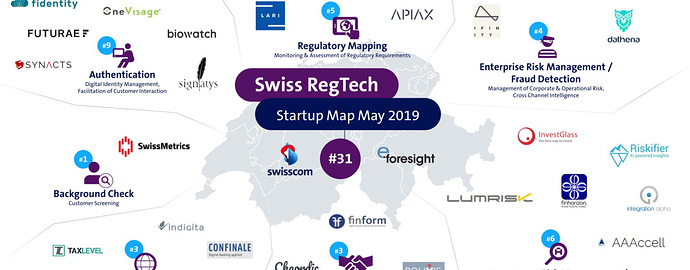

Switzerland has no fintech-specific regulations. A technology-neutral approach has been adopted, meaning that the same rules apply to all businesses, whether they are using traditional or innovative technologies. The Swiss government closely monitors new technological developments and the potential need for regulatory adjustments in order to reduce unnecessary administrative burdens.

As a result, the Federal Council introduced a sandbox exemption, which is available to all companies. Under the sandbox exemption, the acceptance of public deposits of up to CHF 1 million will no longer trigger a licence requirement under the Banking Act (subject to the fulfilment of certain conditions).

https://fintechnews.ch/infographic/swiss-regtech-startup-map-may-2019/28848/

1) Due to the low amount of Open Banking and Open Finance regulations in Poland, most startups in Poland are moving away fast from the national market and look for clients outside of the national borders, which often leads to moving headquarters to different countries.

Poland is compliant with the lowest necessary regulations introduced by the European Union as MiFID II, AMLD5, and MiCA.

2) There are no Poland-based RegTechs, but more popular ones in Europe consist of Alyne.com in Germany, Onfigo.com and ComplyAdvantage in the UK, and many others. These companies help with onboarding and verifying customer identities.

Sources:

https://www2.deloitte.com/pl/pl/pages/finance/articles/fintech.html

https://www.wardynski.com.pl/biuletyn_nowych_technologii/2016-08/B16_PL_Czy_polskie_prawo_jest_gotowe_na_fintech.pdf

https://home.kpmg/pl/pl/home/media/press-releases/2019/08/rosnace-oczekiwania-w-zakresie-regulacji-i-nadzoru-nad-fintechami.html

https://fintechnews.ch/regtech/top-10-regtech-startups-in-europe/34253/

https://selleo.com/blog/top-25-regtech-companies-in-european-union-in-2020

As of today, there is no specific regulatory framework in Spain governing fintechs. … In general, fintech businesses focused only on developing IT solutions to support the provision of services by financial entities are not currently subject to any financial regulatory regime.

I find this quite amazing. The Spanish traditional banking sector is making efforts to merge and create bigger banks with greater efficiency.

Last month, Spain has passed a new law relating to digital transformation of its financial system (pending publication in the Official Gazette in the next few days). The law introduces the highly anticipated regulatory sandbox: a testing space that can be used to try out technological innovation in financial services under special flexible rules. The aim is to curb costs and regulatory complexity, while ensuring supervision by regulators and due protection for the market.

In the Netherlands we are following AMLD5 quite strictly especially in the crypto area.

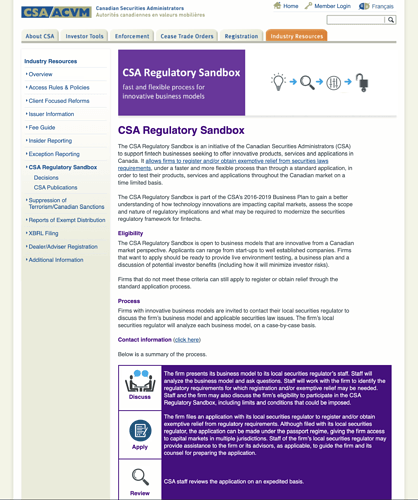

There is no single regulatory body for fintech in Canada. Rather depending on the service provided, different regulatory bodies will have jurisdiction.

Hi @ibin,

Thank you for researching Fintech regulations in your region.

Could you also write them down in the forum? (It will help with remembering and revising the material.)

As well as mention what are the more known RegTech’s in your region?

I’m originally from Iran but been living abroad for over 15 years. the country is under lots of financial sanctions which I still do not know the reasons. Of course there are news agencies coming up with different type of news from naming the country to be involved with lots of illegal activities, but to be honest I can’t really trust the news.

One of the FinTech companies in Iran is called Shaparak(butterfly). Its a company that created a central network to make banks connected together, so people can use their debit cards in any bank. The company is monitoring all the transactions and making sure that the transactions are instant and healthy.

Also it provides API for online shopping.

RegTechs

- Chainalysis

- ComplyAdvantage

- Ascent Regtech

- Forter

- Hummingbird

- Continuity

- Trunomi

- Ayasdi

- IdentiyMind

- Sift Science

- Elliptic

- BehavioSec

I live in LAOS and FINTECH is almost in-existent here.

In 2019 its central bank has officially banned crypto usage and the country is ruled by “Communist” Party not pushing startup cultures.

However Guys really enjoy your posts

I am sorry to hear about your situation

Maybe instead of describing Fintechs in your region, you could try focusing on your region, or a neighboring country, such as China?

If you have any questions then let us know

- Research and find out local fintech regulations in your region.

https://www.finanstilsynet.no/tema/fintech/

https://www.finanstilsynet.no/tema/fintech/fintech-regelverk-og-konsesjon/

https://www.finanstilsynet.no/tema/fintech/finanstilsynets-regulatoriske-sandkasse/

The websites are not in english

- Make a screening of RegTech fintechs in your region.

https://quesnay.com/

https://www.bearingpoint.com/

https://www.ambita.com/tjenester/bank-og-finans/

There are no specific rules or regulations that prohibit or restrict fintech businesses in the Netherlands . … Both the Dutch Central Bank (DNB) and the Netherlands Authority for the Financial Markets (AFM) have recognised that new fintech solutions do not always fit within existing rules (Jun 16, 2020)