Thanks for the awesome feedback

If you have any questions then don’t hesitate to ask

If you have any questions then don’t hesitate to ask

Open Banking regulations in Finland are about implementing the European framework of PSD2, including guidelines. This was done by amending two Finnish laws, mainly by adding Third Party Providers (or Third Party Payment Service Provider, TPP like the Finnish FSA calls it.) So Payment Initiation Service Providers, PISP, and Account Information Service Providers, AISP, were added to Finnish law. At the same time they added Strong Customer Authentication into Finnish law.

Nordea is headquartered in Finland. Their developer portal is found at https://developer.nordeaopenbanking.com/

The PSD2 and Premium API products they offer are the same as the ones shown in this course, Fintech 101. So no big changes by January 2021.

Unlike Nordea which is owned by shareholders, OP is Finnish mutual bank. OP is bigger than Nordea in Finland, but OP is limited to Finland, unlike Nordea which is active in 4/5 of the Nordics, that is in Finland, Sweden, Norway and Denmark but not in Iceland. OP developer site is https://op-developer.fi/

OP has the normal PSD2 APIs plus four more APIs they call Wealth APIs:

Funds, Holdings, Financial Instruments and Custodies. They also have a location API with information on the closest bank branches and they are releasing four APIs in Identity, Health, Housing and Insurance.

According to https://www.openbankingtracker.com/country/finland there are 19 API-aggregators in Finland. Finnish banks seem to cooperate with Neonomics, enable:Banking and Enfuce, among others. Denmark based Danske Bank operates in Finland as well. It has also OpenWrks, Token, Yolt and equensWorldline among others.

Neonomics is a Norwegian company founded in 2017. Enfuce is a Finnish company active in the Nordics. enable:Banking is also a Finnish based company, but seems to be active on the Nordics and the Baltic countries.

- Find out what the regulators in your region are doing within Open Banking. Are they doing something? If so, try to figure out how far have they come and what will or is included in the regulation. Share your findings in the Forum.

- Take a look at a couple of banks active in your region and what kind of developer portals and help they are offering. Can you use any of this for your fintech ideas? Is the service for free or how much will it cost? Share your findings in the forum.

- Research some Fintech API Aggregators in your area and share them in the forum.

.

As the concept gained traction around the world, Canada announced in the Federal Gov’t 2018’s Budget efforts to establish a committee to explore the merits of Open Banking for Canada Now they believe that Canada requires an approach to open banking that incorporates elements from other jurisdictions and harnesses the benefits of both industry and government led models, yet claims to charts its own path.

which players can use ban APIs and access customer data; issues surrounding consent and privacy, stewardship model & the responsible protection of the collective data, including appropriate processes defining the use of the data, what happens a customer’s access requests for changes, correction, deletion and to help make the users and the participants comfortable with these practices and controls.

The regulations are complex in Canada so changes to start gradually, beginning with the Big banks (federal regulations) and expand over time to eventually include the Credit Unions (Provincial regulations)

Significant role to come from the Office of Superintendent of Financial Institutions OSFI; the Canadian Mortgage and Housing CMHC, the Office of the Privacy Commissioner of Canada , Payments Canada, with the Canadian Bankers Association already calling out as a precursor for a more robust Digital Identity system to prevent fraud,

Canada Open Banking Developer Portal - RBC- https://developer.rbc.com

credit card catalogue 2. mortgage minimum down payment calculator 3. branch locater API 4. amortization schedule 5. safety deposit box inventory 6. Product Value API

| API Name | Description | Category | Followers | Versions |

|---|---|---|---|---|

| Helcim Payment Gateway API | The Payment Gateway API by Helcim connects businesses in Canada and the USA with credit card processing services. Accept online payments in the form of Interac Visa, Interac Debit… | Payments | 5 | REST |

| Xignite Calendar API | … countries such as France, Australia, Japan, Germany, Canada , Italy, and the United Kingdom. Xignite Calendar … | Financial | 33 | REST |

| Intrinio TSX Venture Stock Exchange Prices API | … get end of day prices (EOD) from the TSX Venture Exchange in Canada . Available data includes stock prices, adjusted stock prices, and adjustment factors for dividends and splits… | Stocks | 0 | Version |

| Intrinio Real Time Canadian Stock Prices (TMX, TSX) API | … TSX Venture Exchange (NEX). Both exchanges are located in Canada . Quotes, trades, trade cancelations, symbols, and stock status messages are returned via JSON with "SNAP… | Stocks | 37 | REST v1 |

| REST v1 |

| TSX Venture NEX Stock Exchange Prices API | … securities trading on the TSX Venture NEX Stock Exchange in Canada . Available data includes the high, low, open, close, and volume for each stock as well as adjusted prices for… | Stocks | 3 | REST v1 |

|---|---|---|---|---|

| XigniteRates API | … rates from global financial markets in the U.S., Europe, Canada and Asia. schedules. XigniteRates provides interest rates data for over 600 treasury, money market and private… | Financial | Version | |

| Canadian Sales Tax API | … with their applications by using the postal abbreviations of Canada . The following methods are available: Get the current GST (global sales tax), Get the current HST (harmonized… | Taxes | 10 | REST v1 |

| PaymentEvolution API | … payroll service aimed at small and mid-sized businesses in Canada . The PaymentEvolution Payroll API supports calculations from simple federal/provincial deductions through to… | Financial | 3 | Unspecified |

| Tax Data Service API | … and use tax rates by location within the United States and Canada . A list of taxing jurisdictions with authority in a location may also be generated. API methods accept… | Financial | 5 | RPC |

The major banks in the Baltics including Baltic International Bank, Swedbank, and SEB, have all offered to build on top of their services with the use of APIsdue to PSD2 for both AISP and PISP third party players. As far as I can find, all you need is to register with an email, no payment required. TietoEVRY is a company which connects banks from Nordic and Baltic countries.

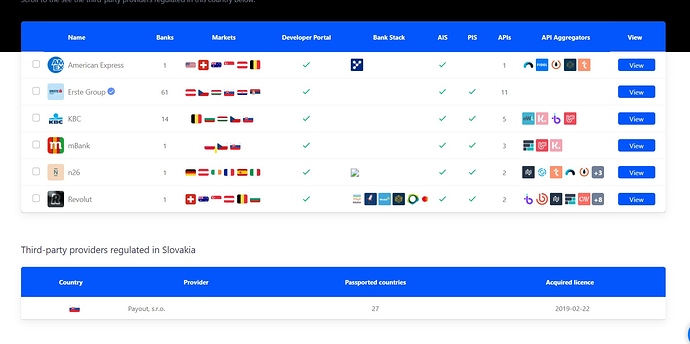

- I have searched for some slovak -only regulations, but it seems that up till now, everybody is just mentioning and following the PSD2 regulation.

- I found one of banks in Slovakia to offer a API Explorer: https://developer.tatrabanka.sk/apiresources . Interesting to visualize what is happening on the inside. Otherwise, they haven’t shown any prices for this service.

- As for aggreagators, I found these ones: Bridge, Fidel, BanqUP, Klarna, Ibanity, TrueLayer.

-

About my country, which is Chile, I found out that there is still not any Open Banking regulation. Recently though, Chile introduced a law that allowed to change from one bank to another in a simple way (though I tried it and never worked), its like a bank portability function, much like a number portability works with mobile operators. I found out that recently the government is analyzing how Open Banking could be introduced (they are already working on this, and it is said that could take from 1 or 2 years and several millions of pesos to translate the documents from english to spanish

) without affecting the previous laws regarding banking, because there are two main stoppers in this case: the current laws regarding the protection of the personal data that the banks have and also some cybersecurity regulations. https://www.df.cl/noticias/mercados/banca-fintech/las-dos-trabas-del-open-banking-en-chile-proteccion-de-datos-personales/2020-11-19/125046.html

) without affecting the previous laws regarding banking, because there are two main stoppers in this case: the current laws regarding the protection of the personal data that the banks have and also some cybersecurity regulations. https://www.df.cl/noticias/mercados/banca-fintech/las-dos-trabas-del-open-banking-en-chile-proteccion-de-datos-personales/2020-11-19/125046.html -

I also found that there are many initiatives trying to give some steps towards open banking, such as prepaid debit cards or user to user payments, but all of them have several constrains (MACH, Superdigital, Chek, Fpayand Dale). I also found out a couple of companies providing services like an API aggregator, but I dont understand how can this happen without there being regulations in palce

. Those companies which I found are: clay.cl , apiservice.cl

. Those companies which I found are: clay.cl , apiservice.cl -

Though there are no Fintech aggregators, I already shared some API aggregators in the previous answer, and I also can share this www.fintechchile.org which is an association of Fintech companies in CHile.

Open Banking in Japan .

Japan’s Banking Act strictly regulates the scope of business that banks and their subsidiaries are permitted to be engaged in. To promote Open banking “Amended Banking Act of 2016 and 2017” allowed more flexible business expansion for banking groups.

To read more about Amended Banking Act https://www.aplaw.jp/Payments_and_Fintech_Lawyer_July_2018.pdf

There are disputes surrounding API’s cost. Banks want to charge higher fees while Fintech argue that API access should be free to promote open banking initiative.

Usage-fee norms have yet to be established.

GMO Aozora Net bank offers a free write-access API and read only API ( for payment service providers).

MUFG offers an identity authentication API

Fintech API Aggregators

Netstars Co., Ltd

-

As far as Open Banking regulation in the US or even in the state I live in - California, there is no shortage of .coms and apps proclaiming to be at the fore front of this new wave of transformation, so to speak. The driver for Open Banking in this environment is Section 1033 of the Dodd-Frank Act which legislates that US citizens can allow access to their financial data. Open Banking is being “encouraged” in this context by a central body, the Consumer Financial Protection Bureau (CFPB).

-

I personally use a Credit Union, not much different from a bank - save that a credit union usually places emphasis on the community in which it resides, i.e. stimulating local small businesses mostly, maybe even several small personal loans if they be well collateralized w/ somewhat of a sickening interest rate. This particular banks online/mobile presence was abysmal as recently as last year, but has been improving by leaps and bounds through their partnership with a local programmer/developer. They even have API integration! However, they do not offer any developer portals or incentives for Fintech starts or the such and almost nothing they do for their customers is for free. A secondary bank is Finicity - it is an online bank w/ no credit check. They also offer high level API integration, a very slick UI and hybrid services with an emphasis on control over not only your finances but of your financial data as well, their services are largely for free, they make money on loans, overdrafts and TX fees apparently.

-

Plaid is based out of San Fransisco, CA, USA and is a Data Aggregation API Provider. It will be very interesting to see if there will be any exclusive integrations between companies like Plaid and price oracle companies like ChainLink or BandProtocol.

1.)Find out what the regulators in your region are doing within Open Banking. Are they doing something? If so, try to figure out how far have they come and what will or is included in the regulation. Share your findings in the Forum.

A.) As usual, The UK are trying to be ahead of future regulations and utility companies are entering the Open Bank movement, which in itself creates massive opportunities in that market place.

2.) Take a look at a couple of banks active in your region and what kind of developer portals and help they are offering.

2b.)Can you use any of this for your fintech ideas?

A.)absolutely. I am already on the case and have started to plan the roadmap for the short(12-18 months), medium19-36 months and long term37-60 months,

3.) Is the service for free or how much will it cost? Share your findings in the forum.

A.)This is a subject I am not willing to discuss in the forum at this stage and is Subject to NDA, However. I am willing to discuss outside the forum, just ping me a message with contact details .

4.) Research some Fintech API Aggregators in your area and share them in the forum.

A.)Again, see previous answer.

Open Banking in Fintech - Assignment.

With regards to Sierra Leone in West Africa and its Fintech regulations, there are some movements happening with this sector, although, it is moving at a slow pace. Recently, the government intends to reduce as much as possible off shore foreign exchange transactions and compelling all remittances and foreign disbursements to be paid through the domestic banking sector.

The government is finalising regulations that will address issues such as currency swapping with key trading partners, hoarding of foreign currencies in homes and paying daily subsistent allowances in the current host countries.

There is a Credit Ref Act (CRA) 2019- provides the legislative framework for the Central Bank of Sierra Leone to operate an interim Credit Reference Bureau Unit which is currently not operating.

Actions have been taken establishing Anti Money Laundering (AML) unit and banks are now adhering to international regulations like KYC, KYD, KYT which are opening up the banking sector. Little steps are taken toward cryptocurrency and assets acknowledgement, hopefully there will soon be regulations adopted for the operations of such assets.

United Bank Of Africa (UBA) is using TIER 1 Low KYC to encourage the unbanked and under banked to have bank accounts in line with the Financial Inclusion Strategic Intent of the Central Bank. There are mobile banking services offered by the banks. The telecoms and few other private businesses are also using the little regulations allowed to offer money transfers within the country and outside the country, with special license from the Central Bank. They use apps to do the transactions and it is a booming industry.

In terms of Fintech API Aggregators, not much. But I see huge opportunities for this technologies deployment in the near future. I hope to be doing more research to take advantage of the opportunities using Fintech to address the problem customers are facing.

FinTech - Open Banking Regulations in the Philippines.

- BSP - Bangko Sentral Ng Pilipinas -

[Draft Circular on Open Finance]

[Draft Circular on Open Finance]

The BSP conducted a survey with BSP-supervised financial institutions (BSFIs) in April to

June 2020 and completed a comparative study of regulatory landscape in other

jurisdictions to better understand how open banking / open finance has been

implemented and identify what needs to be considered when developing a framework

for an open finance regime. Respondents were generally supportive of the idea signaling

the need for BSP to draft the circular with due consideration to feedbacks and learnings

gathered.

Also, In the Philippines’ data privacy law was influenced by EU’s stringent data protection regulation, including the adoption of the General Data Protection Regulation (GDPR).

Source: Rhttps://business.inquirer.net/276948/rcbc-leads-the-way-to-open-banking-in-the-country

-

Union Bank of the Philippines - API CATALOGUE “Displays the full list of APIs available for developers” https://developer.unionbankph.com/product

-

Tagcash is for individuals, Companies and developers with awesome wallet features and mini apps.

PayMongo supports businesses of all sizes, works cooperatively with various financial institutions. Its products mainly include a payments API that may be integrated into e-commerce websites and apps.

- Spain follows EU regulation related to PSD2. As all major banking institution comply with this regulation, it open the door for smaller players to be integrated in the system in more collaborative environment.

- BBVA is one of the major banks in Spain with an advance IT platform. BBVA integrate all other banks accounts information on its own application. For the user is more friendly to connect to a single app and see all the accounts. BBVA benefits from all the information gather from its customers to target the products to them. There is no cost to the users as there is an implicit benefit from BBVA on gather all this information.

- Just on BBVA Spain, there is 7 different API depending on the use case business, payments, checkouts Financing, posted the link https://www.bbvaapimarket.com/es/banking-apis/?filters=country-spain but there are also others institutions offering API from major banks like Santander, Bankia, Bankinter as show in this link https://www.openbankingtracker.com/country/spain

-

Portugal is part of the EU, so the PSD2 regulations are followed by the banking industry

-

In a move to meet the PSD2 directive, 95% of bank accounts in Portugal are accessible, covering account information, payment initiation, and availability of funds.

The biggest Portugues banks that provide API service are:

-

ActivoBank

-

Millennium BCP

-

Santander

- The only one I could find in Portugal was SIBS https://www.sibs.com/

- Find out what the regulators in your region are doing within Open Banking. Are they doing something? If so, try to figure out how far have they come and what will or is included in the regulation. Share your findings in the Forum.

In Germany, it seems that the most important regulation within Open Banking is the upcoming Payment Services Directive (PSD2) which will be active for all Europe.

- Take a look at a couple of banks active in your region and what kind of developer portals and help they are offering. Can you use any of this for your fintech ideas? Is the service for free or how much will it cost? Share your findings in the forum.

Quite a few German banks offer developer portals and APIs. I found this open banking tracker website which shows a list of many German banks and which of them have developer portals, which have APIs and how many.

https://www.openbankingtracker.com/country/germany

- Research some Fintech API Aggregators in your area and share them in the forum.

I didn’t find any native to my area, but there are plenty in Europe like:

Ibanity, Bridge, BankingSDK, BanqUP, Fintecture, Salt Edge, etc.

There’s a list as well on the same website linked earlier:

https://www.openbankingtracker.com/api-aggregators

- The UK is taking a top-down approach to the open banking regulation through the Financial Conduct Authority (FCA) to enable data sharing between the initial set of banks and building societies and registered third party providers.

Under the FCA rules, providers must have approval as speciality providers or payment businesses either in the UK or under current passporting arrangements. The provider is then under direct supervision from a UK or EU regulator.

This framework then aligns with the EU’s revised Payment Services Directive (PSD2), which requires providers to be PSD2 compliant. The entire regulatory framework allows the CMA to promote open banking as a transparent and secure way for consumers to control their finances.

To streamline communication between banks and third parties, the CMA (Competition Market Authorities) established the Open Banking Implementation Entity (OBIE). This oversees a dedicated IT platform known as the Open Banking Directory which allows regulated providers to enjoy a secure exchange of information via open APIs (application programming interfaces).

Open banking is also working to provide an authorisation dashboard that should make it easy for customers to access information and cancel permissions. Third-party providers are being encouraged to provide their own mechanisms.

The Financial Services Register allows consumers to check whether providers are authorised to provide the following services:

- Payment initiation services to instruct direct payments rather than through a third-party service

- Account information-sharing services that enable you to see multiple provider information at a glance

-

The leading challenge bank in the UK is Clydesdale Bank PLC. They help the TPPs once they get a licence of the FCA. Service is free. The API Balances lets you retrieve a list of balances and the amount of borrowing on the customer’s consented accounts. https://developer.cybonline.co.uk/

-

TrueLayer https://truelayer.com/

Products:

PAYMENTS API

DATA API

PAY DIRECT

Following industries are covered:

Wealth tech,

iGaming,

Market places,

Personal finance,

Digital banking,

Credit&lending

I think there are a lot of space in personal finance data. For example fintech could be linked with crypto mortgage program. In this case the offer shall be accepted by client as well as a mortgage broker and might be another third party. Therefore aggregator of API is very important.

- I checked the library of congress and the federal reserve and open banking is’nt a thing. no surprise really.

- I checked 2 of my banks websites and didn’t find any developers sections. Since the US dollar is the world currency for now, the banks are monopolized.

3

https://www.mx.com/assets/images/resources/moneysummit/financial-data-aggregation-chart.png

According to Fora.com, Ireland is following Sweden in regards of Open Banking, Even thought the level of Activity of Aips its lower as a expected, AIB bank has emerge into the technology, where it is now possible to manage your account and loan application

One practical use case is ‘account aggregation’ where information from various accounts – with the permission of the user – can be brought together in one application.