That’s a really good page you posted thanx. I recommend it. The Swiss know how to do this stuff.

Australia has over 800 companies in the fintech space. Grew from a 250 million industry in 2015 to a 4billion industry in 2020.

No1 in the world for contactless payment.

Australia boasts the 4th largest pool of managed funds in the world

2nd highest penetration of smartphones in the world.

Ventre of creating world blockchain standards.

Fintech regulatory sandbox leads the world.

https://www.fintechaustralia.org.au/wp-content/uploads/2017/10/FinTech-Ecosystem-Map-medium-res.jpg

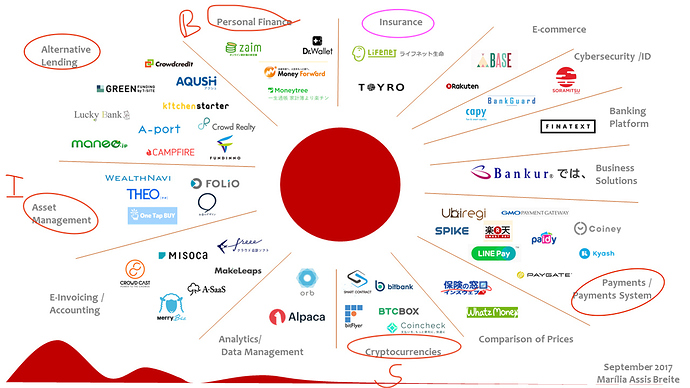

Japan seems to have a well balanced Fintech companies. Everyone is well connect to Internet so easily accessible but I don’t know statistics about adoptability and usability of the services.

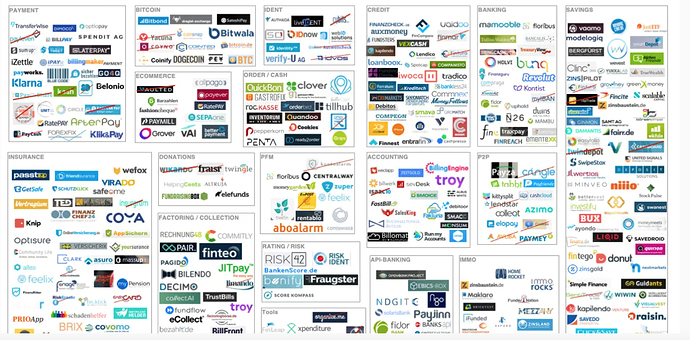

The Fintech market in Germany has many companies participating, some banks like Fidor and Bitwala war well established in the banking sector. The problem here is that a vast majority of people (also young people) prefer the traditional banking system with local saving banks. It’s a huge potential market, but any company in the sector has to face the traditional scepticism of Germans against everything that is online. Once this can be overcome there is a huge potential in ALL Fintech areas to be exploited. Possibly a way to overcome the scepticism is providing easy working apps and an excellent 24/7 phone backed customer service with personal help and no or little waiting holds.

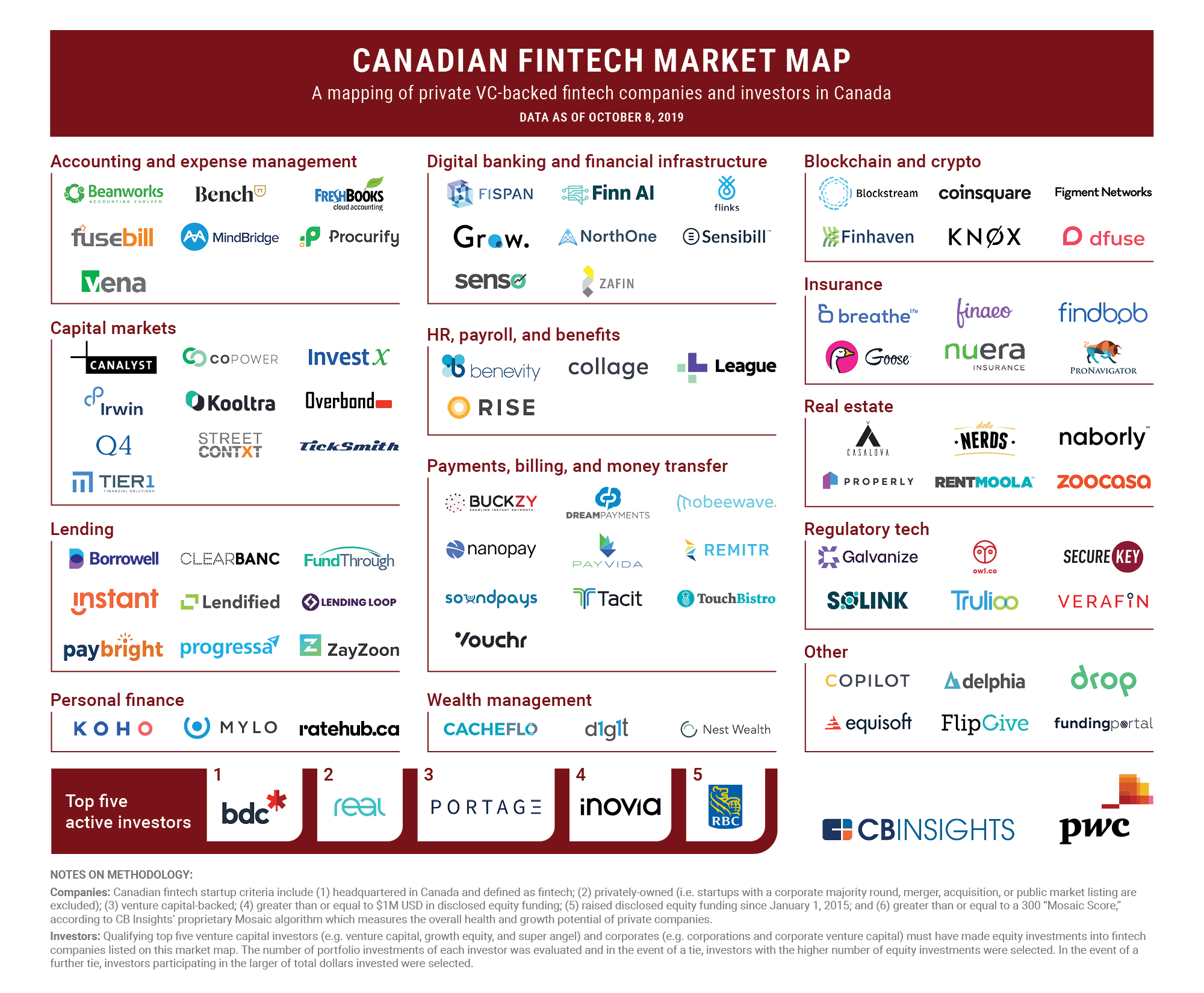

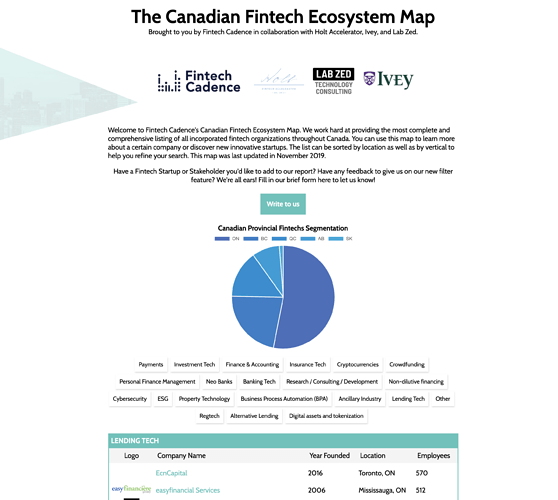

Canadian market is underserved in rural markets

Three cities are currently driving the fintech market Calgary, Toronto and Vancouver.

Opportunities arise in payment services where merchants consistently complain about high transaction costs

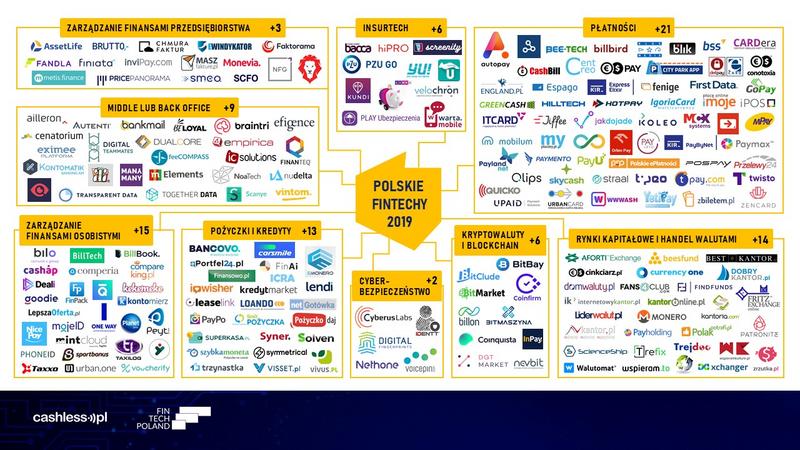

After screening existing fintechs in my region and connecting the information with the previous assignment, I believe that Poland lacks quality fintechs in many areas, especially Lending, Saving, and Investing.

Previous Assignment:

This is the document explaining in detail Polish fintech industry. (Unfortunately, it’s in Polish.)

https://www.cashless.pl/system/uploads/ckeditor/attachments/2258/mpf2020b.pdf

I found a website and a database of 204 Finnish fintechs. That’s too many to look into. I made a selection of six companies between A and F in the alphabet and I noticed that according to my understanding investment banking could be an area which is underserved. Or those kinds of services can better be provided by bigger regional and global players so there are no opportunities if you aim only at the Finnish market.

Airpay Digital https://www.airpaydigital.fi/ In corporate card payments - retail or commercial banks

Basware - https://www.basware.com/ payments services - retail or commercial banks

Clento https://www.clento.fi/ KYC solution - for all banks except central banks and perhaps investment banks (that have mainly institutional customers as far as I know)

Detech https://www.detech.fi/

Asset and liability management (ALM) - probably all forms of banks except Central banks and perhaps investment banks

eKeiretsu http://www.ekeiretsu.fi/

not in banking but in logistics, health, municipalities and insurance

FA solutions https://fasolutions.com/

wealth management - applicable for most kinds of banks except Central banks and perhaps investment banks.

Not easy to get an overview. There are a lot of companies here in Germany, too. I found this lists: https://big-picture.com/fintechs-germany.php or https://fintech-consult.com/germany.

Hi @CryptoMel,

Thank you for the catch.

We have adjusted the question and answers. It should be correct now.

Thank you for screening different fintechs in your region.

@spongetti, @Rick.Everitt, @Lucky_Mkosana

Could also expand on what areas you feel may be underserved in your region?

In my opinion opportunities are in the field off funding regular SME’s through retail crypto investors. I have only seen this with fiat money instead of crypto.

- Make a screening of existing fintechs in your region by using google and map out which kind of banks that they are focusing on. Then estimate the areas that are currently underserved in your region (in other words, where the opportunities are)

What I see is that the space is way to large even in small countries, so I have to just take some companies right now and find opportunity out of that as an exercise since I already know what I need this course for. Time is valuable right now so I need to research what is relevant for me right now.

Zwipe - contactless payments that integrates chip tech

Banksoft - lending service

Promon - Security-service for blockchain and traditional banking. No clear information about what marked they are targeting. But lets say they are targeting retail banks. To my limited knowledge, they are securing paying, loaning, lending, saving and investing at least. Maybe also insurance, but as I see it at first glance, this is a specialised product for the whole banking sector. Very clever!

Kameo - lending and payment for businesses

Monner Crowd - lending and payment for entrepreneurs

Local music is still an undeserved market. No one has a viable solution that actually helps them to this day.

My country is Austria.

I was surprised to see so many “big” fintechs from Austria.

Underserved regions: Asset management / investment banking space.

*Make a screening of existing fintechs in your region using google and map out which kind of banks they are focusing on.

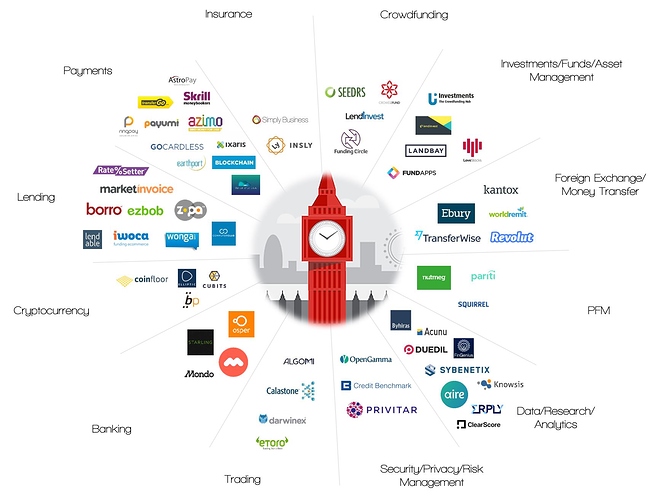

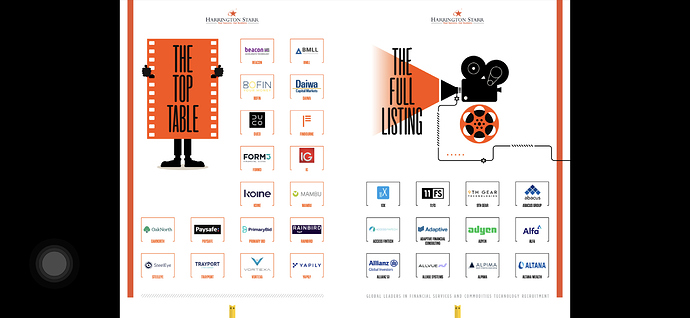

The United Kingdom has many hundreds of Fintech’s and the Financial Technologist magazine publish an annual review of the those that are most influential. In this case 187 were selected for the 2020 edition.

*Estimate the areas that are currently underserved in your region (in other words, where the opportunities are)

As explained by our esteemed tutor and lecturer Gustaf, the U.K. (as with much of Northern / North Western Europe) is extremely well served as to Fintech solutions aimed at the Retail consumer and also the SME, and less well served as regards the medium sized and global corporations and still less so the institutional customer, from what I can surmise.

One company that I am affiliated with, Volopa (which is part of the Quantum Group) is aiming at that higher end of customer base, where they have not only a first class Retail service (and B2B2C solutions via white labelling with partners) but are also targeting the high-level business and corporate sector with multi-currency prepaid cards (up to 14 currencies to which gold & silver will be added), and also they specialise in Cyber Security, and separately Lifestyle (& luxury) products and services. This year they launched the first Nigeria-specific remittance service (Oya, which is fastest and cheapest in-market payments arriving in around 30 seconds), made some strategic acquisitions, and will also target newer innovations in the coming year.

The U.K. also has an outstanding RegTech sector and in the assignment on Financial Regulations the Top 10 will be illustrated in my answer to the corresponding question there.

Blockstream - Blockchain & Bitcoin

Borowell - lending

Mylo - investing

PayBright - spending

There isn’t a lot in lending/borrowing, saving, or insurance. In general, all areas seem underserved.

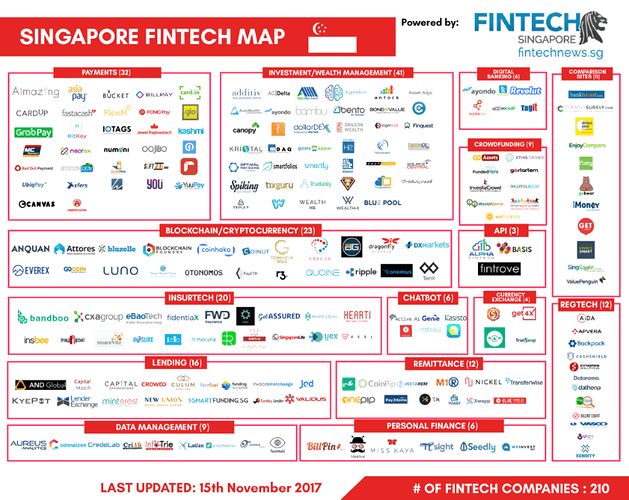

In Singapore the fintech landscape is pretty stacked. There isn’t a lack of companies providing services across the 6 pillars.

In fact Singapore also recently granted digital banking licenses to a dew fintech companies like Grab.

Where I see an opportunity is actually in the persona finance space. Being able to equip individuals with the right knowledge to pick the right solutions for their financial needs.

What do you guys think?