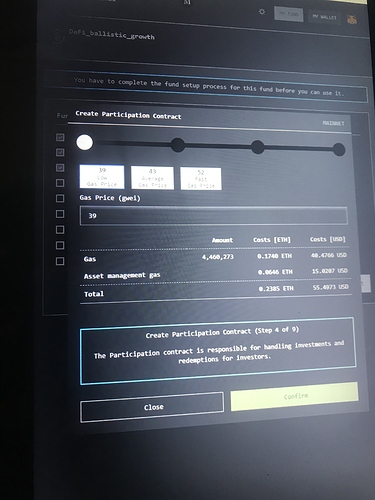

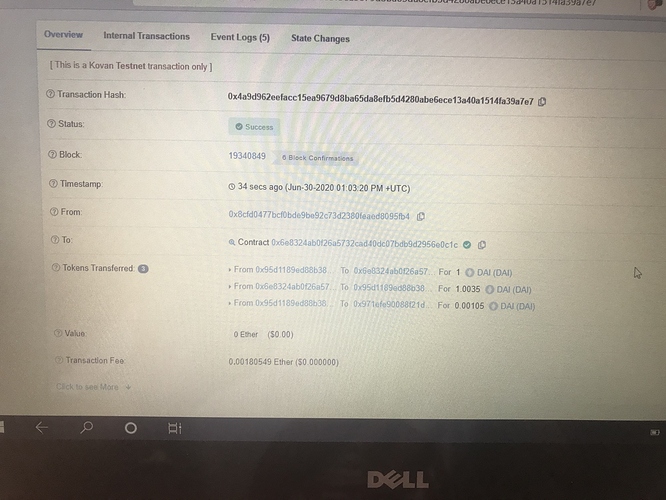

Hello , I’m creating a hedge found in melon … but I’m in step 3/9 and so far I payed $40 in gas fee and $12 in the actual price … how is that possible?

Is it a good idea to open the hedge found on this times even if the price will be around $300 because of the gas fees ?

Agreed.

Yep good point. I was playing with the idea of partially or completely eliminating the downside risk by creating a service that locks in eth and a short position and generates hedged eth token that could be used as collateral for MakerDao. It would eliminate the risk of vault liquidation and essentially be maintenance free. No need to close the short on another platform to re-collateralize the vault.

Only problem with this idea is that MakerDao are probably very strict about what they accept as collateral. Would probably be hard to get this hedged eth token accepted. Oh and the fact that if you hedge your eth you cant make any profit from your hedged eth if eth price goes up. Would only be useful in bear market basically.

Yes a lot of projects rely on DAI but I think this makes DAI more trustworthy since its been tested more than other projects.

Thanks for your feedback!

I understand your concern. The way I see it is that DeFi doesnt need to be perfect to make the world more equitable. The current system is so messed up and unfair… i mean the bar is really low. Almost anything defi does will be better than the current system.

Haha very true but I think its an important discussion to be having early, especially if you are in a position that could lead to comparatively pretty extreme wealth after this next cycle… DeFi has amazing potential to allow community based projects (literally within your own town) to grow exponentially… I just think it’s more important that the people who are going to be profitable explore what they are going to do with their wealth? Will you spread opportunities, try to help your community or others less fortunate? Or will you HODL your way into a gated community to join the rest of the selfish people that oppress the underclass? These comments aren’t directed at you personally btw but I think it’s an important discussion to have especially potentially heading into one of the worst recessions the world has ever seen… who doesn’t want to be rich? It symbolises freedom… I just see the ethics of blockchain as an interesting thought experiment, especially seeming that a lot of the sentiment around the space is ‘un bank banks’ … ‘financial revolution’ etc etc…

Yes I agree it is a discussion worth having.

Look into the tokenomics of how melon protocol works and you might understand why the gas is a bit higher than normal

Why they say is about $50 in that case ?

For a start if a contract is more complex it may require more gas, also to my understanding there may be an internal gas system within the melon protocol as well…

Is it worth to pay that amount of gas fees ?

Depends… what are you trying to accomplish by opening an account?

When I opend my hedge fund it looked all to be just fine

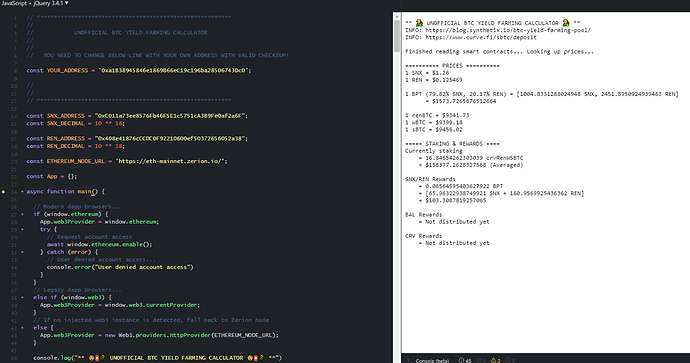

Guys I want to share this cool tooling:

https://jsfiddle.net/3pjcmtaq/

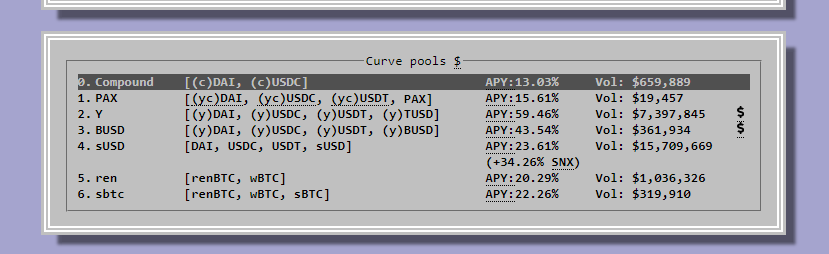

Who is doing some YIELD farming?

Guys amazing times.

What is your YIELD return at the moment?

I build a portfolio with an stable 15 APY

And having some more risky assets pools getting bit insane.

I’m an expat from northamerica ‘stranded’ in Egypt due to Covid19. I’ve come to really like it here so I think I will stay…and would like to do it on crypto primarily.

Now, CeFi here have a guaranteed bond backed by the government with a yield of 15%, payable monthly, and term (locking of capital) is one year. How does DeFi compete with that!

Now with a modest investment*, one can live VERY well here…I live in Roushdi which is the equivalent of upper west side Manhattan or Marina district San Francisco…all for the cost of public housing (I kid you not)…however I cannot participate in this CeFi due to being on extended tourist visa.

I bank with HSBC global and did open an account here but their equivalent is 12%, term of 3 years and there is no way I am locking up capital that long.

Now the underlying currencty is EGP, the egyptian pound note which trades at about 15:1 USD or 17 EURO or 11 CAD give or take. I don’t think it’s Lebanon here either but somewhat sound. Their military is fairly strong.

This is a great course and great introduction to many projects out there. Are there projects that will guarantee returns at rates comparable to this 15% government backed one that will not lock funds for 1 year? Or are there community members who have achieved this with their coin funds for a period of 3 months+?

If a fund could do that I could see it taking off but at present crypto here is just not up to speed with the rest of the world.

Best regards

*PS: When I say modest investment, you could seriously retire and live comfortably on 50,000 Euros with 15% APY payable monthly/dailey. Now, I know no financial advice but in truly living off crypto I have seen on other videos people in NorthAmerica are using ‘coincards.com’. This is regulated and everyone seems to swear on this as a means of living off crypto and not evading taxes…seem clear cut tax evasion to me the second you use those cards…what say you?

Furucombo is very cool but without knowing the exact arbitrage opportunity combination at a given time it really does not work. Are we going to dive into finding the arbitrage opportunities?

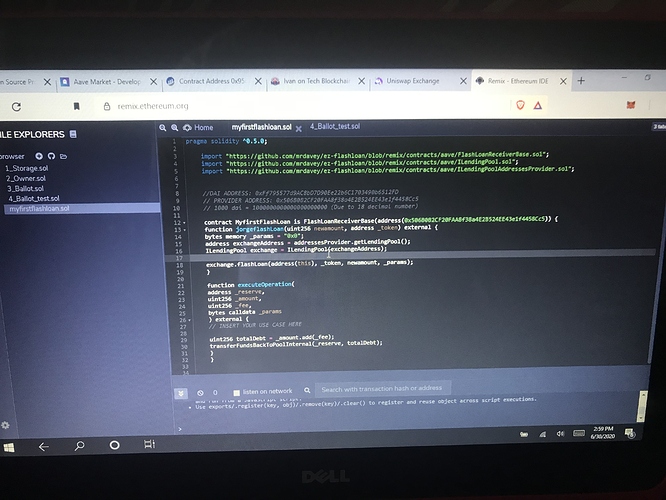

Hello, Does anyone knows the meaning of this error?

Fail with error ‘SafeERC20: low-level call failed’

I got it by commenting line118 of arbitrage.sol

require(daiBought > totalDebt, “Did not profit”);

At the moment I wanted to run the contract even by losing money just for testing.

@Andrewgaven

It would be that you check the code line that you commented well, I executed the code with the line “require (daiBought> totalDebt, “Did not profit”);” commented and the code was executed without problems.

You can build robots for this but overall this is not really something that is possible to be efficiently done by humans. It is possible to build bots for this that scrap data and act.

The most important thing is that you understand to underlying financial working of the protocol.

Then the next step would be is understanding that the current system is flawed … then build your strategy and build long term wealth and work hard. There will never be a free lunch but you can always make calculated risks.

I will release a basic DeFi investment strategy soon that would help all to make the transition to a new system and incentives us to do so.