NO.1 FMZ

In the book “Financial Alchemy” written by Soros in 1987, an important proposition was put forward: I believe the market prices are always wrong in the sense that they present a biased view of the future.

The market validity hypothesis is only a theoretical assumption. In fact, market participants are not always rational, and at each point of time, participants cannot fully acquire and objectively interpret all information. Even if it is the same information, everyone’s feedback is different.

In other words, the price itself already contains the wrong expectations of market participants, so in essence the market price is always wrong. This may be the source of profit for the arbitrageurs.

NO.2 FMZ

Based on the above principles, we also know that in a non-effective futures market, the market impact of delivery contracts in different periods is not always synchronized, and the pricing is not the reason of completely effective.

Then, based on the price of the delivery contract at different times of the same transaction target, if there is a large spread between the two prices, it is possible to simultaneously trade futures contracts of different periods and carry out intertemporal arbitrage.

Like commodity futures, digital currencies also have an intertemporal arbitrage contract portfolio associated with them. For example, in the OkEX exchange: ETC week, ETC next week, ETC quarter.

For example, suppose the spread between ETC week and ETC quarter is maintained at around 5 for a long time. If the spread reaches 7, we expect the spread to return to 5 at some time in the future. Then you can sell the ETC week and buy the ETC quarter to short the spread. vice versa.

NO.3 FMZ

Although this spread exists, there are often many uncertainties in manual arbitrage due to the time-consuming, poorly accurate of manual operations and price-changing effects.

Through the quantitative model to capture arbitrage opportunities and develop arbitrage trading strategies, as well as programmatic algorithms automatically release trading orders to the exchange, to quickly and accurately capture opportunities and efficiently earn income, which is the charm of quantitative arbitrage.

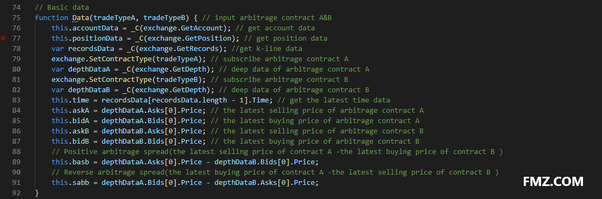

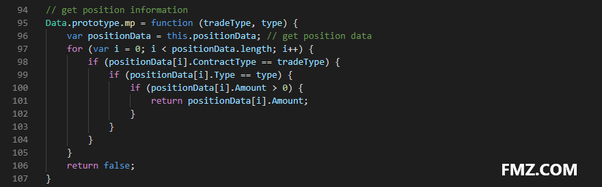

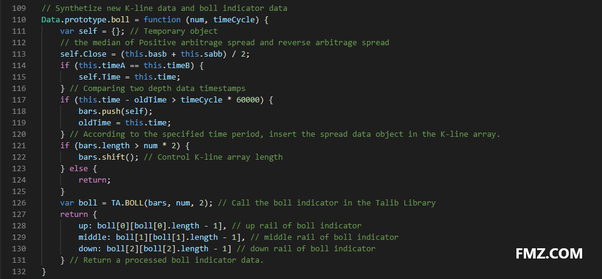

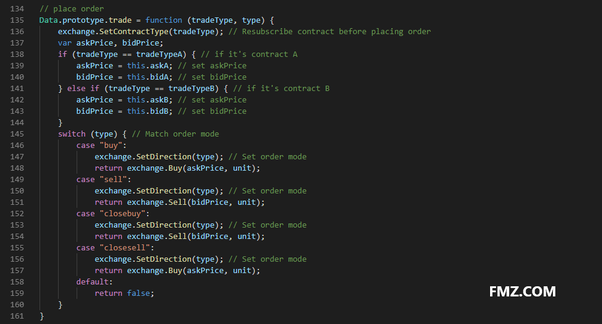

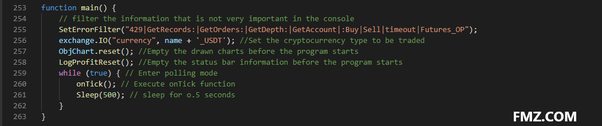

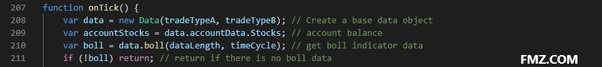

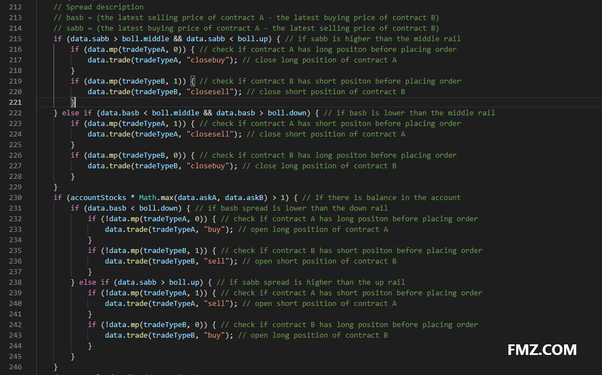

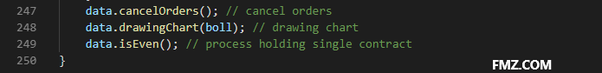

This article will teach you how to use FMZ quantitative trading platform and the ETC futures contract in the OkEX exchange in digital currency trading, with a simple arbitrage strategy to demonstrate how to capture the instantaneous arbitrage opportunities, and seize every visible profit while simultaneously hedging the risks that may be encountered.