Running into issues y’all!

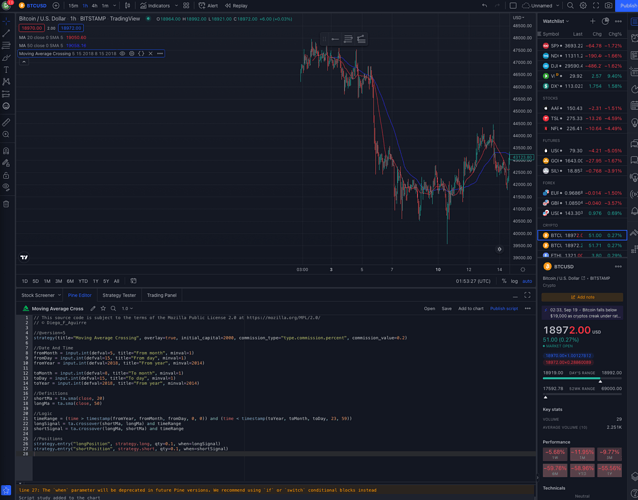

So, I’m fairly certain I got the right code:

// @version=3

strategy(title = "MA Cross", overlay=true, initial_capital=2000, commission_type="strategy.commission.percent", commission_value=0.2)

// DATE AND TIME

fromMonth = input(defval=5, title = "From month", minval=1)

fromDay = input(defval=15, title = "From day", minval=1)

fromYear = input(defval=2018, title = "From year", minval=2014)

toMonth = input(defval=8, title = "To month", minval=1)

toDay = input(defval=15, title = "To day", minval=1)

toYear = input(defval=2018, title = "To year", minval=2014)

// VARS

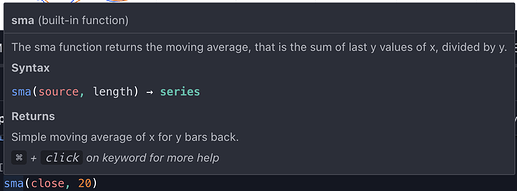

shortMA = sma(close, 20)

longMA = sma(close, 50)

// LOGIC

timeInRange = (time > timestamp(fromYear, fromMonth, fromDay, 00, 00)) and (time < timestamp(toYear, toMonth, toYear, 23, 59))

longSignal = crossover(shortMA, longMA) and timeInRange

shortSignal = crossover(longMA, shortMA) and timeInRange

// POSITIONS

strategy.entry(id="longPosition", long=true,qty=0.1, when=longSignal)

strategy.entry(id="shortPosition", long=false, qty=0.1, when=shortSignal)

When I “Add to Chart” I can see it, BUT, I only get 19 trades total and it runs until now-ish (2021).

Clearly something is not right, so what am I doing wrong?