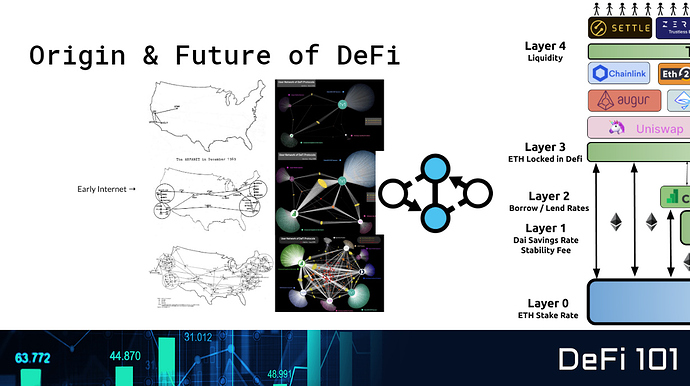

I’ve been learning what I hoped to with this course - a good in-depth but broad overview from the ground up of this quite specific de-fi space - and which tends to be exclusively Ethereum based, historically.

A newer chain that I’ve been watching for some time, and that i feel might be interesting for De-Fi is Zilliqa. I was pleased to see that Ivan has just recently started some Scilla tutorials, and I really enjoyed the first coding lesson - and for me it’s great to see their project moving nearer to actual products. Zilliqa were also the first chain on Unstoppable, before they launched .crypto domains on Ethereum chain.

Also, it will be interesting to see what is possible smart contract-wise with Cardano’s Plutus . . . I have seen there are sandbox tutorials, but not delved in yet.