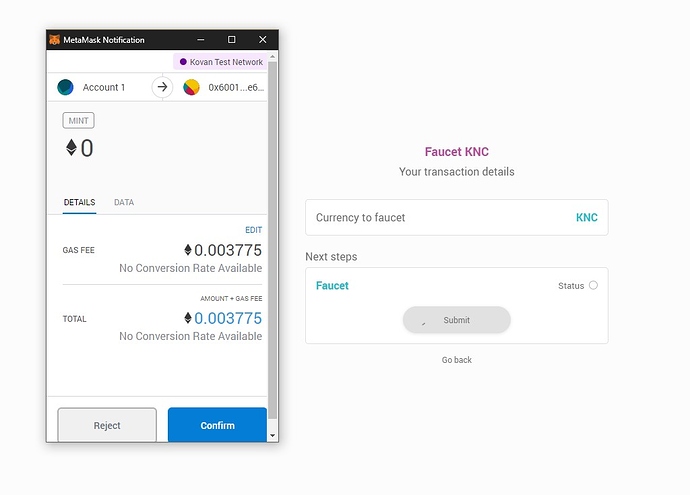

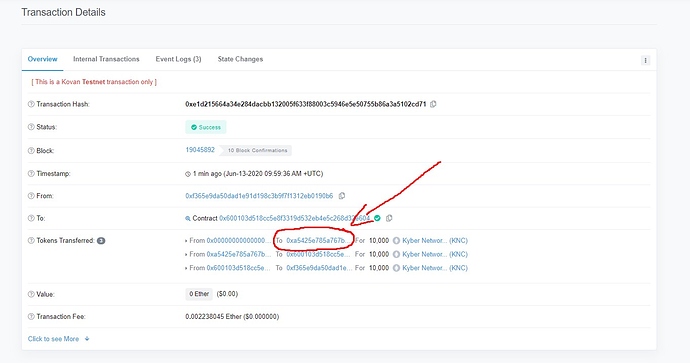

I might have had the same problem yesterday. At least when it shows the “Something went wrong” error on the faucet page. They don’t show the error, but it’s a “daily limit error”. I tried this morning, and that worked. So it might be depending on the time of the day.

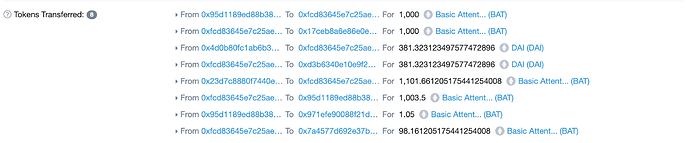

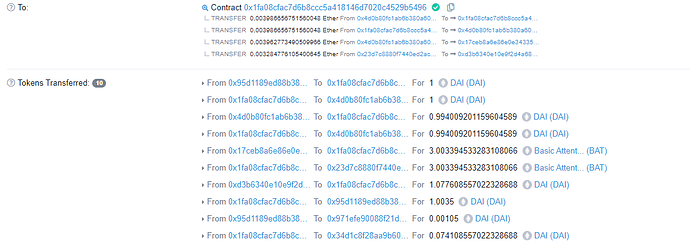

What is your address? I can send you some DAI / BAT / ETH

Thank you so far!

Thank you so far!

I’m dying to imply this on the mainnet (Obviously after abit more practice, But this currently is my best option to get out of where I am now xD) Alot of debt, physical work and barely covering my bills still so I can barely make it to invest every month even 200 USD of crypto… That’s why I jumped on DeFi 201, had to see this opportunity but it seems like I can’t afford it for now ahah…

I’m dying to imply this on the mainnet (Obviously after abit more practice, But this currently is my best option to get out of where I am now xD) Alot of debt, physical work and barely covering my bills still so I can barely make it to invest every month even 200 USD of crypto… That’s why I jumped on DeFi 201, had to see this opportunity but it seems like I can’t afford it for now ahah…