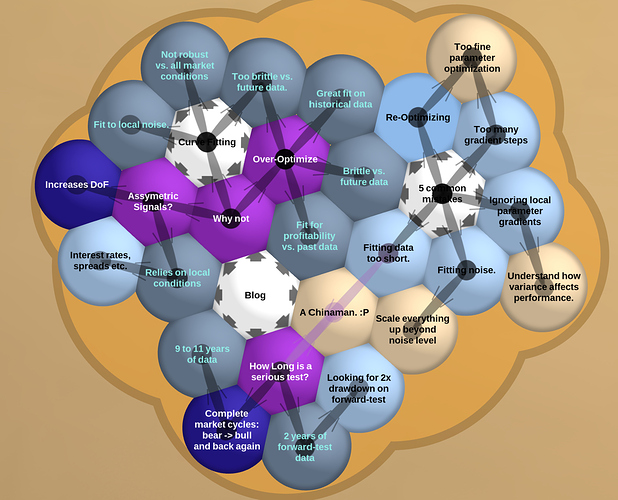

In this reading assignment we will dive deeper into the most important issue when it comes to building a profitable trading strategy - Backtesting. We will look at some of the common mistakes, over-optimization and curve-fitting and how you can avoid them. Read through this blog post and answer the following questions in this forum thread. Use the knowledge you have learned so far as well.

- What is so dangerous about over-optimization?

- How long should a testing period be if you are serious about building a profitable trading strategy?

- Why should you avoid asymmetric trading signals?