(1) How does the writer define technical analysis?

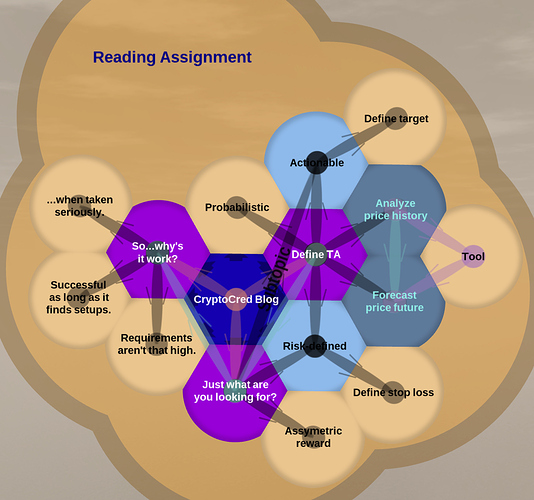

i. Technical analysis is the practice of analyzing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price

ii. TA is a risk management tool that can be used to derive probabilistic, actionable, and risk defined trade setups on an instrument.

(2) What are technical analysts looking to identify in the market?

i. To help a trader carve out an edge and a positive expectancy in the market(s) they trade.

(3) How would you summarize the authors argument that technical analysis works?

i. Generating risk-defined trade setups to establish risk management.-

The writer defines technical analysis as a risk management tool that can be used to derive probabilistic, actionable, and risk defined trade setups on an instrument.

-

Technical analysts are looking to carve out an edge and a positive expectancy in the markets they trade.

-

I would summerise them as, technical analysis can’t read the future but will help you find pasterns and reduce your risks of trading in an asset.

hi @filip

- Technical analysis is the practice of analyzing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price

- An analyst is looking to derive probabilistic, actionable, and risk-defined trade setups on an instrument.

- Technical analysis work if you consequently and systematically use TA and strategy for your trades, observing instrument and using technical analysis to work out a most probable future scenario how ie. token\share will behave in near future and base your trades on own prediction on systematic and consequent market observation.

-

How does the writer define technical analysis?

Technical analysis is a risk management tool that can be used to derive probabilistic, actionable, and risk-defined trading setups on an instrument -

What are technical analysts looking to identify in the market?

the change of a bullish or bearish move ment. -

How would you summarize the authors argument that technical analysis works?

Analysis has to meet for it to work are not unreasonably high

It doesn’t have to predict the future, nor does it have outperform the professionals

1. How does the writer define technical analysis?

«Technical analysis is the practice of analysing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price. »

2.What are technical analysts looking to identify in the market?

Historical price patterns and probabilistic, actionable, and risk-defined risk/reward trading setups.

3.How would you summarize the authors argument that technical analysis works?

As long as it helps traders identify and trade asymmetric risk/reward trade setups, it works.

- The author defines what the technical analysis is and is not in order to fully explain this term. According to the author, the technical analysis " is a risk management tool that can be used to derive probabilistic, actionable, and risk-defined trade setups on an instrument" rather than simply “analysing price history to gain knowledge of the future price of an instrument”. He than sums up that " technical analysis is a probabilistic risk management tool that can i) generate new trade ideas ii) convert price forecasts into actionable trades".

- The TA is aimed to “generate risk-defined trade setups”, meaning to map up potential entry and exit points.

- It works for those who take it suriously, as it is meerly a tool that allows traders to see the potential market moves based on the statistical probabilty and when using risk/reward properly.

-

How does the writer define technical analysis?

Technical analysis IS a risk management tool that can be used to derive probabilistic, actionable, and risk-defined trade setups on an instrument

-

What are technical analysts looking to identify in the market?

the analyst wants to define the risk for his trade setup

-

How would you summarize the authors argument that technical analysis works?

TA works but a trader who is more systematic and selective with trading will have a better oppertunity for sucess and it requires discipline and patience*

- Technical analysis are not for prediction the future price, its analysing the chart or the price history.

- Technical analysts are looking the price movement in the past and for a different probabilities.

- Technical analysis is a risk managment tool which is used for probabilities of the price and its necessary to use risk defined trades in order to technical analysis work.

-

How does the writer define technical analysis?

Technical analysis is a risk management tool that can be used to derive probabilistic, actionable, and risk-defined trading setups on an instrument -

What are Technical Analysts looking to identify in the market?

Technical analysts looking at Indicators/Waves/Levels in order to identify the perfect trade setup offering asymmetric risk:reward -

How would you summarize the authors argument that technical analysis works?

Technical Analysis works, but you should take it seriously and maybe not solely rely on it.

- How does the writer define technical analysis?

the writer defines technical analysis as the practice of analysing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price…

What are technical analysts looking to identify in the market?

an actionable strategy that increases the odds of Success while minimizing loss

- How would you summarize the authors argument that technical analysis

TA doesn’t have to predict the exact future price of an instrument, as long as the risk-reward ratio favors rewards then the TA is considered to be successful.

- How does the writer define technical analysis?

Technical analysis is a risk management tool that can be used to derive probabilistic, actionable and risk-defined trade setups on an instrument - What are technical analysts looking to identify in the market?

Looking for better odds and for their setups to render them profitable over enough trades - How would you summarize the authors argument that technical analysis works?

Technical analysis is not about knowing/deducing the future price of an instrument.

The point of technical analysis isn’t to outperform professional desks and firms, it’s about whether it can help a trader carve out an edge and a positive expectancy in the markets they trade.

Not all technical analysis is equal — it’s much more likely to work for someone who takes it seriously (disciplined, systematic, etc.) than someone who just takes a punt.

-

How does the writer define technical analysis?

technical analysis is the practice of analyzing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price . -

What are technical analysts looking to identify in the market?

Technical analysis is the practice of analyzing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price. -

How would you summarize the authors argument that technical analysis works?

The requirements it has to meet for that to be true are not unreasonably high. It doesn’t have to predict the future, nor must it outperform better-equipped professionals. As long as it helps traders identify and trade asymmetric risk:reward trade setups, then it works.

1

His own definition is: technical analysis is the practice of analyzing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price.

2

technical analysis is a probabilistic risk management tool that can

i) generate new trade ideas

ii) convert price forecasts into actionable trades

3

Generally, the author claims that TA works more when you do it properly, thus criticizing those who only do it half-heartedly.

Additionally, he finds that technical and fundamental analysis should not be excluded from one another but used in a complementary sense. The author believes that a good strategy is to use both.

How does the writer define technical analysis?

Technical analysis is the practice of analyzing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price.

What are technical analysts looking to identify in the market?

Looking to identify repeating patterns that can be profitable over time by using a set of rules and strict entry and exit points.

How would you summarize the author’s argument that technical analysis works?

It works if you work it. If you have dicipline and follow the rules, you can succeed. One can even mess up moving the lawn, if one are lazy, and run over the big rocks.

- How does the writer define technical analysis?

Technical analysis is a risk management tool that can be used to derive probabilistic, actionable and risk-defined trading setups on an instrument - What are technical analysts looking to identify in the market?Asymmetric risk/reward trade setup

- How would you summarize the authors argument that technical analysis works?It work for those who take it seriously with discipline, systematic approach

-

The writer defines technical analysis as tool for probabilistic price action of an instrument. The goal is to derive an actionable trading strategy from historic data to set up trades with minimized risk, and to maximize profit over time.

-

Technical analysts are looking to identify trends in the market, so they can apply their tools in context to the trend. They don’t try to outperform other traders, but simply try to find an edge for themselves.

-

The author argues that TA employed by a patient and systematic trader works, whereas occasional, non-strategic TA doesn’t.

-

Technical analisys is a method of making an actionable and probabolistic trading forecast in order to help the trader make a better risk/reward assesment of a trade based on the price history. It’s not a future forecasting tool.

-

TA triest to identify the probabilities of future trades ( high expectancy of a positive outcome for the trader ).

-

TA is a suplementary tool that is very personal to every trader. The author emphasises the fact that both the fundamentals and TA are important tools that help the trader to make informed dessisions in order to increase a positive outcome for his trades. Both tools are important and both should be studies, honed and taken very seriously.

-

How does the writer define technical analysis?

The writer describes technical analysis, as a probabilistic risk management tool. -

What are technical analysts looking to identify in the market?

technical analysts look to find a technique, or approach to get a higher probability with low risk. -

How would you summarize the authors argument that technical analysis works?

i personally love the approach the author gave in the article. It is not simply if technical analysis works, but the way you define work. also i believe it has to “work” in some way, otherwise why have a chart? why not just have numbers that tell us the price? people look at those charts for a reason, whatever the reason. They are looking for a strategy, pattern, sign of some sort, which is analyzing a chart in a way, and from that you get your conclusion.

does it “work”?

-

How does the writer define technical analysis?

The writer defines TA as; technical analysis is the practice of analysing the price history of an instrument in order to make actionable, risk-defined forecasts of its future price . -

What are technical analysts looking to identify in the market?

Technical Analysts are looking to identify probabalistic, actionable and risk defined trade set ups -

How would you summarize the authors argument that technical analysis works?

In summary, the argument is not whether or not TA ‘works’ but more about the individual using the tool to its best potential and in the right way, with the right mindframe.