Went and did my homework although it turned a bit anticlimactic  . I ended up buying a Cryptokitty (yes, they’re on Opensea too! ), since I couldn’t find anything closer to “real value” on the platform. I don’t intend to disrespect artists, but i’m not as insane yet to buy a GIF.

. I ended up buying a Cryptokitty (yes, they’re on Opensea too! ), since I couldn’t find anything closer to “real value” on the platform. I don’t intend to disrespect artists, but i’m not as insane yet to buy a GIF.

On the WIV topic, according to their site:

Can I get the wine delivered?

Not yet. The assets will be securely stored in a professional warehouse in our custody. We are looking [it], but we need to ensure that the value of the wine is protected. So in due time, you will be able to drink up your token, but for now, look on your wine as an investment asset that is being protected in a vault.

I agree nevertheless that this is a fantastic use-case to bring a real-world asset on chain. At the moment without a due date on when delivery is available, this is nothing different than an “illiquid derivative” (pardon the pun  ), another virtual asset.

), another virtual asset.

On the other hand, I did some learning out if this exploration process!

ERC-1155 Multi Token Standard: Essentially lets you bundle multiple assets of different types into one. I think bundles have become an important economy driver (Humblebundle, etc.) and is nice to have such tool available on Ethereum (and Defi!)

I was talking to a comic artist, and he mentioned the struggle of monetising his content. Physical products don’t give him much return after intermediary costs, and (according to him) there is way way less demand for the virtual content. While I see this more of an adoption and cultural problem, it is difficult to convince them to start creating assets and publish on chain, since Ethereum itself has such high fees (if purchase is small amount).

With bundles, it could be attractive to creators, so that they can sell bundled content for low fees? Sorry if this is a bit out of the DeFi topic, although, all we need is a way to include it as a building block  . Royalty management teams maybe?

. Royalty management teams maybe?

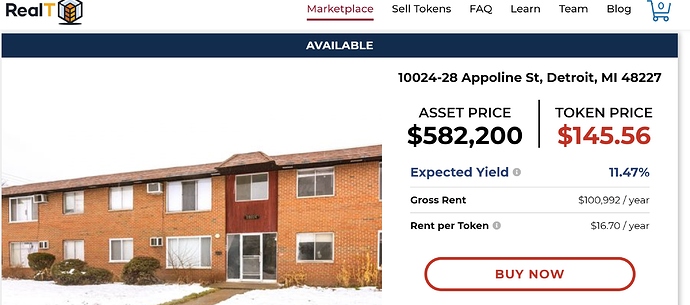

I assign all to find interesting new protocols that interact with the real world and show proof of purchase in the forum thread. For now, you can use https://opensea.io/assets/wiv but soon many more will follow.

I assign all to find interesting new protocols that interact with the real world and show proof of purchase in the forum thread. For now, you can use https://opensea.io/assets/wiv but soon many more will follow.

. I ended up buying a Cryptokitty (yes, they’re on Opensea too! ), since I couldn’t find anything closer to “real value” on the platform. I don’t intend to disrespect artists, but i’m not as insane yet to buy a GIF.

. I ended up buying a Cryptokitty (yes, they’re on Opensea too! ), since I couldn’t find anything closer to “real value” on the platform. I don’t intend to disrespect artists, but i’m not as insane yet to buy a GIF. . Royalty management teams maybe?

. Royalty management teams maybe?

.

.