Here you can discuss and ask questions related to the course section “Trading Independently”

Hi everyone,

I’ve completed the trading 101 course and absolutely loved it, thanks so much @Chris, it was great to learn from you!

I’m writing my first basic trading plan and would like to know if it makes sense. My goals for this example is to earn about $1000 per month.

Could you or anyone please take a look and let me know what are other factors we need to consider before starting?

Here’s the example trading plan:

Account = $3000

Risk = 1%

Reward/Risk ratio = 3:1 or 4:1

Plan details

4 trades per week = 16-18 trades per month

$30 per trade (1% of account)

With a reward-risk ratio 4:1 = 20% win rate is required to break even

18 x 20% = 3.6 = 3.6 (4) trades required to win

To Break even (or small profit)

With 4:1 $120 per winning trade = $120 x 4 trades = $480 profit

With 4:1 $30 per losing trade (1%) = $30 x 14 trades = $420 loss

PROFIT = $60

With 3:1 $90 per winning trade = $90 x 5 trades = $450 profit

With 3:1 $30 per losing trade = $30 x 13 trades = $390 loss

PROFIT = $60

To Profit (not factoring fees)

With 4:1 $120 per winning trade = $120 x 10 trades = $1200

With 4:1 $30 per losing trade (1%) = $30 x 8 trades = $240

PROFIT = $960

With 3:1 $90 per winning trade = $90 per 10 trades profit = $900

With 3:1 $30 per losing trade = $30 per 8 trades loss = $240

PROFIT = $660

Are these win / lose ratios realistic for new traders?

Hi there,

I have followed the Technical Analysis course and I’m trying to trade independently now. However I still need to perform my craft. I was looking for more advanced technical analysis courses. I found one on Udemy that was supposedly Advanced but covered exactly the same topics than this course with Chris Bailey unfortunately. I have even tried to reach out to Chris himself on this matter, but didn’t get any response back. Does anyone know or can recommend a solid Advanced Technical Analysis course? I would be very appreciated.

Take the Advance Technical Analysis course here on the Academy. They have automated trading course where you can build your own algorithm from scratch and give you advance trading tools and knowledge. Keep in mind the is no one place that fit all or will teach you everything you need to know about trading or investing. You need yo keep using different tools to get the knowledge you need. First you need to find what type of trader you are and get knowledge for that. Am a swing trader, trend trader and investor in Crypto and Commodity. I like to use the Heikin Ashi chart because it takes out the noise from the market and easy to read, DMI combine with ADX it shows buying, selling and how strong the trend is, parabolic SAR for placing a stop lose and following the trend or when the trend will reverse, Zig Zag for shows the higher highs and lower lows, it have a pattern when you see the triangle goes up three time it has to come down three times too, that’s the pattern and Awesome Oscillator it shows how strong the graph is and who’s in control of the market. Faithfully I was able to help you. Let me know if you have any other question.

Thank you so much for sharing your thoughts on this. As a beginner in this field, it is essential for me, as I think, to read such reviews of people who have been in this field for a long time and, of course, understand much more than I do. I would like to know what kind of service you use to place your bets. I know that some of my friends use the forex brokers service. Do you think this service is suitable for those just starting? I know that you need to start just the same with good services, but for some reason, I doubt that I will succeed on service of this scale.

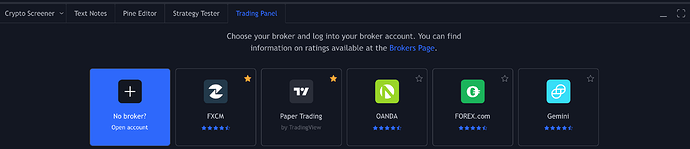

I’ve tried out the setup we learned in the trading course, which is using TradingView with a broker that can be connected to directly from the platform, like FXCM. There are also other brokers in the trading panel option you can explore and a paper trading option for practicing strategies. I am not familiar with the forex brokers you mentioned as I haven’t used it. I hope this helps. All the best with your learning and trading goals.

Which exchange would you recommend for a beginner?

I have not taken this course yet, but they say it is great. I want to take it in the future. I usually read articles about investing on Investor Junkie

I have not taken this course yet, but they say it is great. I want to take it in the future. I usually read articles about investing on Investor Junkie. In one article, I read that trading is one of the main things worth investing in and making money on. So I’ll have to try trading, especially considering I’ve saved enough money this year to invest it and hopefully earn more. I hope I can understand the whole trading system. I’d like to say ‘thanks’ to everyone who shared their opinion. It is very important and informative!

I think that your plan is sifted through and very detailed. However, you should never exclude the possibility of losing big sums. So it’s better to start with smaller ones. I have a friend who invested about 2000 dollars without a firm and well-thought plan. He was going to work ‘intuitively,’ and he never gained anything.

Moreover, he even lost part of the sum. I started from smaller sums and used a few platforms from here https://www.doughroller.net/investing/the-best-online-stock-trading-sites/. I liked e-toro the most because it’s very easy to use and stable. I suggest you start from the partly free platforms and move further slowly.