Hello everyone, I am new on Uniswap. Having some difficulties. So I was able to swap some ether for some Trustswap, but after the successful swap, I don’t know where to locate the new Trustswap token i traded for. Please help! do I do it through Etherscan? Then after locating where can I move it? Metamask is only for Ether tokens right?

Metamask is an ethereum wallet which houses Ether & erc20 tokens.

Etherscan just allows you to explore and view the blockchain and wallets.

Sometimes you must configure metamask to look for your particular erc20 token (contract address).

Within metamask there is a window to add a token, where you will have to input the contract address, symbol, and decimals for it to show up.

If you need more help, just message me. Cheers

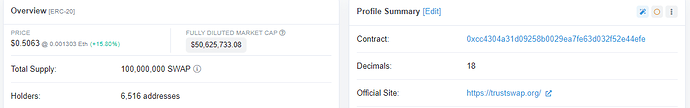

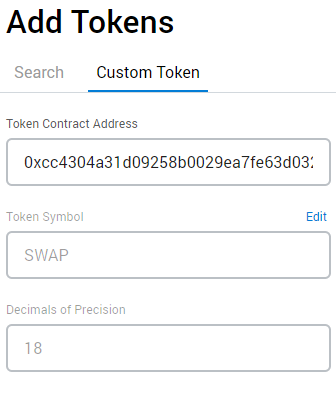

Thank you so much for the reply! That makes sense, but which address am I adding, would you give me a step by step? so I tried to add token, but SWAP does not show up, so i assume I am doing Custom Token? I tried that with address from etherscan “internal transaction” where it gives two addresses To and From, I used the address on “TO” but accidentally put 0 decimal. I believe it is 18 (it says so under Etherscan Profile summary… is this the correct place to find this number?). Any the incorrectly added one shows 0 balance of course. Sorry for these newb questions, I am very lost.

So I pulled up the etherscan page for the Trustswap project here.

I pull three items from this portion of the contract page.

Contract: 0xcc4304a31d09258b0029ea7fe63d032f52e44efe

Symbol: SWAP

Decimals:18

Open Metamask, and click “add token”.

Input the information on the “custom token” tab. (usually inputting the contract address will cause the symbol and decimal to populate as automatically, but for some projects you’ll have to put in all three)

Click next and add the token. You should now be able to see your SWAP.

Send me a message if you have any questions!

THANK YOU SO MUCH!. I really appreciate you taking the time to show me my friend!

Yes, it worked!

Awesome! Glad I could help.

Hey guys

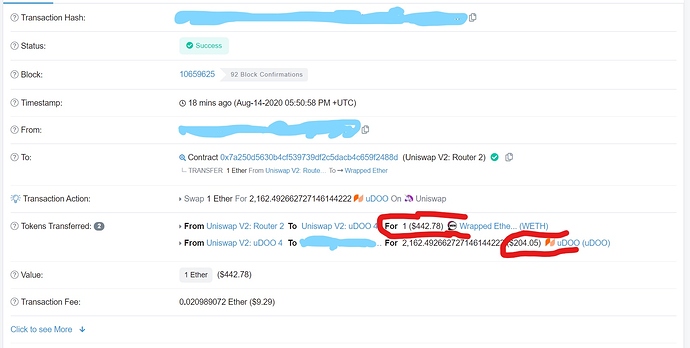

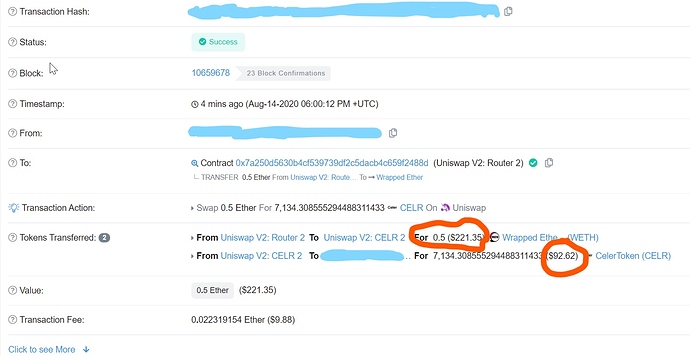

I recently used Uniswap to trade Celler and Howdoo and I was shocked to discover that 1/2 and 3/4 of my money was lost through the swap transactiona

As you can see in the transactions below I would invest around $400 in a coin and I would get back around $100 value in the new coin

Not sure what happened. I was trading during high volume and I had toggle expert mode on and the slippage percentage on max 5%

Could the toggle expert mode overweight the 5% slippage and therefore have more than half my money gone?

See the ATTACHED pictures below

Thanks

Yiangos!

I had exact same thing happen to me, I can’t find any answers as to why, have googled and watched videos on YouTube. There is no clear way to see where has all that money gone!

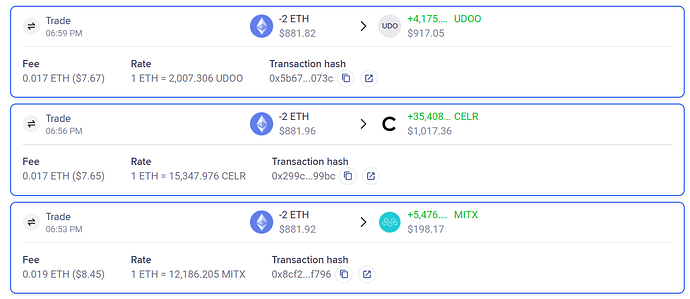

from $880 x 3, I got roughly $350 UDOO, $460 CELR & just $300MITX, I have looked at the transaction fees and these are all less than $10 each, and there seems to be no obvious reason as to why nearly $1500 just disappeared. Slippage was increased to 5% as last week my transactions just kept failing, but obviously the missing ETH is more than 5%, so that is not an explanation to me.

Looking at the rates too, for CELR and UDOO, the charts show that these prices were never reached and the rate for MITX shows 12186 per ETH but i ended up with 5476 for 2 ETH in total!!

Thanks in advance to anyone can help clarify what is happening here.

Kind Regards

Daniel

Thanks for the detailed information, I had similar issue.

Fees have been astronomically high recently. Slippage is another issue which if left unchecked might be eating much of the value. There are many newer or low-liquidity tokens that have extremely high slippage. Front-running could eat a lot of the value if that is the case. Be careful and make sure your settings in Uniswap are set how you want them to be, also make sure to read all of the interstitial menus that tell you what is going to be transferred and how much you’ll receive.

Hope this helps.

Just watched a video on about this today https://www.youtube.com/watch?v=qkiKTW7_OgQ&t=667s . One issue with Uniswap can be the available liquidity pool. If you buy a token that has a small pool it will drive up the price. He suggested always do small Uniswap trades to test the pool. I picked up some PRQ today and paid a $20 gas fee so this may not be practical in many cases. I just started trading on UNI a couple days ago so I do not yet know how to really investigate the liquidity pools yet.

Thank you for taking the time to provide the link

yes, do small trades and pay high fees or do bigger trades and lose through slippage, no straightforward way around it really it seems, just got to hope we pick some winners that make the fees seem so small in the long run.

Thanks again.

thanks for the information and advice, appreciated.

What I do is to always go on coingecko and then check how much my set amount of eth will give me for the token. For example, if it shows 1 eth trades for 98k celer network tokens and if I do that on uniswap and it shows me only 50k. I would lower your eth amount as there is probably not enough liquidity. Trade in small amounts. Also on coingecko, you can see the amount of liquidity that is available for each exchange.

Another one is slippage. I usually set my slippage to 0.5-5% but usually stick to 0.5 - 1% depending on the volatility of the token. I usually edit my gas fee and pay a bit more gwei on it to decrease the slippage. Ethergas station is a good site to get an estimate of how much gwei you can pay.

I hope this helps:)

Thank you. This was great info for me

A way around is to trade into a number of different tokens, then trade those into the coin you ultimately want. Unfortunately, Uniswap fees can kick your butt with this.