Wait a second…but if ampleforth peggs DAI the stablecoin will still be stable.

Then DAI could used as a new currency by pricing Bitcoin , Eth and all the others???

There we go , no more FIAT ahahahah

I am.going nuts but it should make sense

Hi Theo!

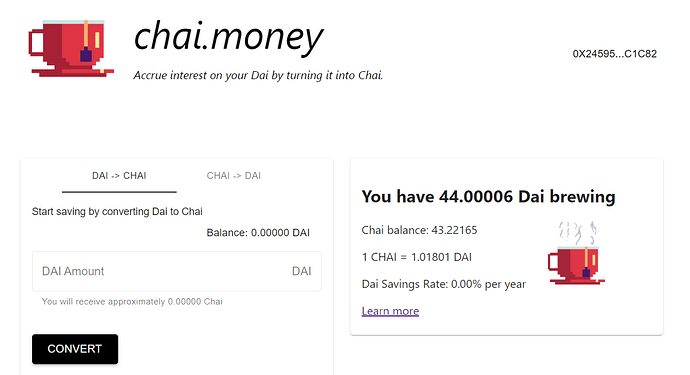

I did the same printscreen and posted here at the forum (but in other topic). It’s really interesting to have those saving rates, especially after watching the videos with 7 or 8%.

I asked some stuff around on twitter and the creator of Bankless (it’s on some of this courses lectures) passed me the following article:

Read it well I am sure you will have it more clear why we have 0% rates at the moment!

Take care.

Thank you very much for your reply it was helpful

VERY constructive share

Hello Amadeo,

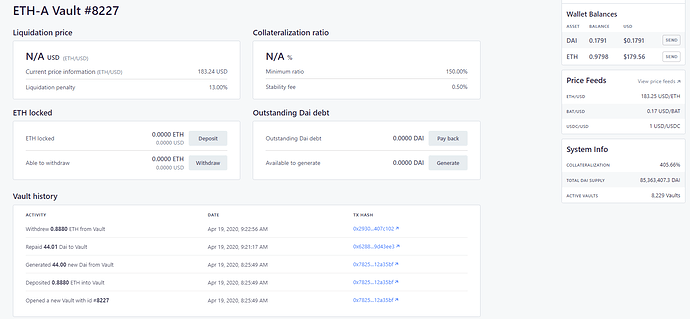

I wanted to play around with blockchain/explorer, EtherScan, Metamask and OASIS app.

Firstly, I sent from crypto.com wallet some Dai converted into ETH via coinswitch which then I sent to my hot wallet metamask.

It seems that I might have done a bad manipulation and never get those ETH into my metamask. The status for this order ID is “TIMEOUT” I then created a coinswitch ticket to ask what happened. They replied asking me to “provide them the transaction hash of the coins I have sent, the exchange is waiting for the coins to start the conversion process” for the Hash ID of this transaction.

I sent then an email to crypto.com support to request the tx ID of this transaction but not did a response yet.

Do you know how I could by myself retrieve this Hash ID for this specific transaction from crypto.com? (I downloaded my transaction history from their app but could not find this hash id)

Please let me know if this is the right place to ask for such request. If not, I will advise.

Thanks in advance for your help,

Great contetnt and walk through Amadeo!

Realy like what Maker Dao is working on. Have as well been on Maker Dao Meetup with your colegue Petru Catana. Realy great team!!

I am looking to build some DEFI product but still develping ideas with team at Slovenian Blockchain association.

One quick and dirty opportunity is to spend money on mastercard (with 0% interest rate) convert in Dai and mint some interest:)

BR Jaka

Yeaa lets use the BRRRR money printer to arbitrage

Creating a universal cryptocurrency debit card, wherein one will be able to use it anywhere in the world in their local currency without any hassles of currency exchange or related fees.

Just managed to place dai into Oasis to find out That intrest rates are at zero. But im proud That i managed to do it.

Amazing man.

Just like the world todat lets hope all can go back to normal soon

In the mean time as a next step try to use it does still give intrest rates since it swaps your tokens between stabel tokens and looks for the highst intrest and automaticly arbitrages as well.

https://y.curve.fi/

I really do see many different ways this will disrupt banking. Getting a loan or making interest on your investment is now just a mouse click away. It will be amazing to see how everything scales as the market share grows.

To test things out I opened a new vault using Oasis on the Kovan Test Network then deposited some DAI and ETH into Compound. Was pretty easy. Only took a few minutes.

Maker and DAI is pretty cool. I’d consider using it as a place to park idle cash in the future. Right now though the DSR is zero since DAI is above $1 and the stability fee is only 0.5% to incentivize people to mint new DAI (increasing supply and putting downward pressure on the DAI price back towards 1). If you need some cash that’s great, but not so great if you’re looking for returns while hodling crypto (that doesn’t support staking). The centralized lending platforms like Celsius and Nexo have better stable coin returns at the moment.

It’s unfortunate there are not better returns in decentralized protocols on crytpo assets like ETH directly. You again need to look to the centralized lending platforms. I suppose you could provide liquidity on Uniswap or Kyber, but the risks are more complicated:

Transaction History

- Opened a new Vault with id # 1485 (https://kovan.etherscan.io/tx/0x64f19f1d6032afec54fa3ab58241bdb6f66181ce3d3defec3329b9b1549c4c45)

- Deposited 0.5000 ETH into Vault (https://kovan.etherscan.io/tx/0x64f19f1d6032afec54fa3ab58241bdb6f66181ce3d3defec3329b9b1549c4c45)

- Generated 20.00 DAI from Vault (https://kovan.etherscan.io/tx/0x64f19f1d6032afec54fa3ab58241bdb6f66181ce3d3defec3329b9b1549c4c45)

- Deposited 20 DAI into Compound receiving 942 cDAI (https://kovan.etherscan.io/tx/0xf8bbbaae7baf5947ea8714edac1c322f4c9fedec0184013c64f9be065565c83d)

- Deposited 0.2 ETH in Compound receiving 9.1670 cETH(https://kovan.etherscan.io/tx/0xc9fdde7cba273b062b43b5bab977bb9ac1f985235226e9efacebbdf5ed4976e0)

Amazing man keep it up

what does everyone on the forum think about the lastest news on European Central Bank cracking down on Decentralized Stablecoins? We need to continue this work further and make it available to more. They will do anything they can to stop this which I think in long term is very bad. As mentioned during the course stablecoins have a certain future and an important role to play especially in countries which lack a stable financial system (which ultimately is most countries).

Of course, I’m as upset by this proposal as anyone however, it seems that (worldwide anyway), this crackdown will have a hard go of it. Simply because USDC is fully regulated within the USA already. Given coinbase.com’s prominence in the space and compliance with existing US regulation, a ban could be considered unconstitutional by the US court system.

Yes totally correct, they failed miserably in India, which is a very very good sign. Fortunately, for all freedom loving people there is some justice left for Free Market principles. Court system across countries must of course also closely followed this development. I am no lawyer but I also cannot see how a court could reasonably argue against it. Banning this would have huge further implications because it sets jurisprudence for other matters in money market systems.

I fully agree thanks for sharing Amadeo!

Did a few transactions on the Kovan testnet and it is great for playing around with stuff, because it’s so fast. Plus, if there’s a mistake, it’s not real money; just have to get another testnet ETH tomorrow from the faucet.

I think there’s a unique opportunity in the CDPs, with all of these low prices. The interest rates are just a distraction from the possible gains in collateral prices. So, hypothetically speaking someone could put their entire paycheck into collateral in a CDP, and then borrow USD for their living expenses, for a year. If they used 50% DAI and 50% ETH as their collateral, on Compound, they’d have some extra value retention when ETH goes down in price. If ETH price went up 100% throughout the year, then it’d be like getting a whole year paycheck for free. You could just withdraw the extra year paycheck by borrowing DAI.

Hi,

is it possible to use Brave browser and Metamask as wallet?

I am trying to use Oasis to connect to Metamask always but jumps into the own-Brave-wallet  …

…

Any trick to use Metamask in Brave and Oasis?

Answer: no need to add Metamask has extension because Brave includes CryptoWalletMetamask already included…

I will try assignment with Chrome…

Who did read this? https://oasis.app/terms

Assignment … both DSR at Chai or Oasis at 0% …

(not interesting for DeFi future as Gas and SF are always paid … ) but practice makes learning worth more than 1000 images …

Thanks for DeFi101 course … very interesting … feeling much more confident that I am able to search for and use DeFi opportunities now …

looks like for DAI+ETH at this instant Uniswap liquidity-pool is the one ‘paying’ the most, if we believe eg. at estimates from

https://1inch.exchange/#/earn