I will not start a Fintec company. I go through the course for understanding the world of finances a little bit better. But when you explained R.I.C.H.E.S. I felt very inspired. Real time means to be in the now time, to express what is now, to do what to need to be done. Intelligence is cognitive straight thinking and associative like island hopping. Software and blockchain must be more intuitive and integrate associative space. Humans think in symbols, the symbols are pools of experience. Using words we share information but it is more than an information, it is a world of symbols behind. Contextual is asking if something is meaningful for you. For that you have to know what makes sense for you, who you are and what is your vision. If you want to create something contextual you need to know the visions of your customers. So in the fintech product should be integrated real time cOmmunication in an online Community or a vision platform. Human feel like humans when they are in contact, free and Social . Further they need love and visions without that we are only software. Being extendible is my talent. I always find creative bridges between world of products. I thing I can offer companies my service to expand products in building netbridges, in finding new unexpected markets by connecting worlds of users. Is there a name for such a service?

Real Time: Transactions will be done near realtime

Intelligence: Service can advice users to attach certain attributes to their profile and it will show attributes attached to wallet they are transacting with.

Contextual: Service can provide information overall transactions and overall requirements of attributes needed. Create reports etc. Build transparency.

Human : Instead of only providing technical guarantee of transactions, help user to build trust in service by allowing to set customisation what he/she feels important

Extendable : Trust is something that is hard to create between anonymous parties, trust can be built based on attributes and positive transactions users do on the network.

Social: Data can be shown like in donations how I compare to other donators. Data also can be show which targets get most of the funds etc.

Real time – Real-time transactions and instant updates.

Intelligence – Tracking, recommendations and making things intuitive and helpful.

Contextual – Opportunities to present other product offerings?

Human – Use of RPA or AI Bots, it could be scalable much faster with a human monitoring the chats.

Extendable – Repeatable and scaleable?

Social – By collecting feedback from our users/investors and using testimonials.

Real time: Payments can be easily settled without waiting for any tx’s approval - efficiency.

Intelligence: Providing users with educational insights on investing and saving on the app on the go.

Contextual: Cater for users’ needs by providing meaningful services with were they are in their investing journey.

Human: Having no human interaction catalyses the speed of services with no delays.

Extendable: Being able to be interoperable with other companies by providing a particular service/functionality. Embedded finance.

Social: Monitor what other companies are doing compared to ours and if we need to adapt to stay relevant in the market.

Based on the project posted

1. Real time - Payments to settled fast and efficient

- Updates on saving and investment status

2. Intelligence - Tracking on savings and suggestions to expedite goals

3. Contextual - Cross selling educational and financial services for the more mature investors

4. Human - Use of bots and Ais for smooth interaction

5. Extendable - Scalability

6. Social - Community to encourage promote and maintain interest among participantsDIGITAL RICHES

These answers relate to my business idea outlined in the last assignment.

REAL TIME

The business proposition is specifically designed to deliver real time data to the user about all their various accounts. All transfers, deposits and payments are made in real time and their impact on the user’s portfolio is immediately apparent.

INTELLIGENCE

The wallet collects data about the client’s portfolio that can be delivered in various formats so as to show many aspects of the user’s financial situation, such as total assets and liabilities, comparisons of payments and credits from month to month, savings, and comparisons with peers. Categorization of payments for example can suggest expenditure items that may be able to be reduced in order to increase savings. Upcoming expenses can be highlighted and suggestions given to allow for these. The user’s ability to access all their financial data in one place permits an exceptionally accurate analysis of the user’s financial situation.

CONTEXTUAL

The use of the user’s data as described above can provide personalized information that is relevant for the user’s particular circumstances. In addition, subject to the user’s permission, notifications can be provided for example about special offers relevant to their spending behaviour, which can facilitate attempts to save. News pertinent to their portfolio allocation or financial interests can also be provided. Comparisons can be made for example between various investments that might suggest portfolio reallocation.

HUMAN

The provision of human interaction with customers is always one of the most expensive costs to a business. However, it is important to give users easy access to human help services via phone or chat services. An extension of “human” interaction in the future would be a personalized AI assistant that can help the user to interpret their financial data, make savings plans etc.

EXTENDABLE

Subject to user permissions, certain relevant portions of user’s data could be provided directly to various professionals eg accountants, investment managers, financial planners; and to financial institutions eg for the purposes of credit applications. These institutions/ professionals would have access through specialized portals. The user, of course, would retain complete control over what segments of their data were accessible to any third party.

SOCIAL

As mentioned above, the user can be provided with comparisons with peers about many aspects of their financial situation, eg nett assets, savings, investment returns etc. The model would lend itself to the development of community forums in which users can share ideas about the use of the application (and suggest improvements) as well as about experiences with lenders, investments, savings plans and so on.

Real-time: Exactly the idea of my app information to be instantly delivered to the customers.

Intelligent: Should in a way to be understandable buy the customers but not too simplified.

Contextual: Use technology to help to find what is needed immediately

Human: Make it clear not only for advanced customers

Extendable: Constantly added new features.

Social: Communication with the community.

Real time – Using an API from valuation data to give current valuation on property.

Intelligence – using above API and some client data inputs will be able to fairly accurately assess value of property, loan amount and equity position and have triggers for milestones so can know when possible to access equity for another project

Contextual – Users see this information as meaningful and will only download app believing so

Human – links back to their originating broker for live chat

Extendable – whitelabel so can be used within real estate agencies and brokerages,

Social – opportunity to share app, property data and milestones with spouse or friends

$1 per bill

- Real Time - this savings method can be included in a way that the app counts or the user inputs the number of bills payed & save $1 per every payment: starting will bills first, extending it to every purchase that we make, to save $1 per every purchase (e.g. higher than $10)

- Intelligence - yes, it offers an intelligent solution, as they start saving with this simple method & then continue - develop an investment mindset

- Contextual - yes, it fits their own possibilities. Everybody can start thinking of saving from $1 on.

- Human - yes, planning to reach customers need through a social media & talk about their gaps in investment knoewledge, possibilitied & needs - diversification.

- Extendable - yes, can be embeded in e.g. Wish, automated when bills are payed on your bank account

- Social - collecting feedback from customers, assesment depending on the personal risk apetite also (when we come from saving to investing diversification).

These videos seem advanced, as if I am actually building a business. I have no financial background. This assignment is like saying to a new student of piano, day one, to sit down and play at concert level. One must crawl before one walks, and walk before one runs. This course did not get me to concert level…

NFTs for the Japanese animation/comic community:

Real Time: Transactions would only take minutes if a decently fast layer 1 solution is used as the foundation.

Intelligence: information should be sharable even with those who aren’t currently using the service so they can be informed of this new method of capitalizing on their artwork.

Contextual: Most people who are into these fan-based artwork in Japan are pretty loyal to the artists they follow so presentation of their work would need to be personalized so those purchasing NFTs from the platform can easily understand what they are buying and the details disclosed.

Human : Human interaction with both the artist and also some technician should be available online dhe duration of each NFT collection sale and also the just before it happens. This way, those who are concerned with their purchases can speak with someone directly. Its pretty much a “all-hands-on-deck” scenario for each sale/auction.

Extendable : the business should be able to integrate with other pre-existing companies in the genre, especially exhibitions and event space where people would often want alternative methods to make their purchases other than the new on-line way. this can further promote limited-edition NFTs only available during special events.

Social: A comparison functionality should be adopted and integrated so those who are looking to compare the differences of more than 2 or more NFTs can have an easy way to compare not only what they want to buy, but also with the portfolios of others (blockchain addresses?)

Real time — Transactions are immediate, fees for crypto can be determined by the user.

Intelligence — Extremely E2U GUI and process.

Contextual — Suggestion system, news, and analytics.

Human — Online agents with minimal actual power, this way it minimizes risk to security but also helps the users by answering any questions.

Extendable — Turn it into a superapp, add a large amount of features without making it overwhelming.

Social — Forum, Discord communities, efficient support, affiliate program.

Real Time: The response to the client request must be instant, if further check is required notify the client an expected time for the final answer.

Intelligence: Approach consumers with a know-need basis. Do not spam them.

Contextual: Be competitive with the market environment. Offer premium product or discount price versus other competitors.

Human: Growth human capital as the business growth. Attract the right people.

Social: Be on the right marketing channels for our potential consumers.

I am not in the process of building a Fintech business. I enrolled in this course to get a better understanding of the sector but I have found the course content valuable and thought provoking.

Real time: possibility to check all business transactions happening with suppliers in real-time

Intelligence: check compliance to contracts and/or risky events in real-time and take decisions

Contextual: it is contextual since it is pervasive on all trasnactions with suppliers and the major source of costs to support the business

Human: the different parties will be able to operate on the same system, open chats directly related to certain events and also call each-others (video calls)

Extendable: after the product is solid in tracking business transactions and contract compliance and offering possibility to settle payments with a token, the idea is to expand to other processes and creat a distributed ERP

Social: clients can decide to clusterize with peers and compare their costs/performances and help each other (this require openness and collaboration tha we can try to foster)

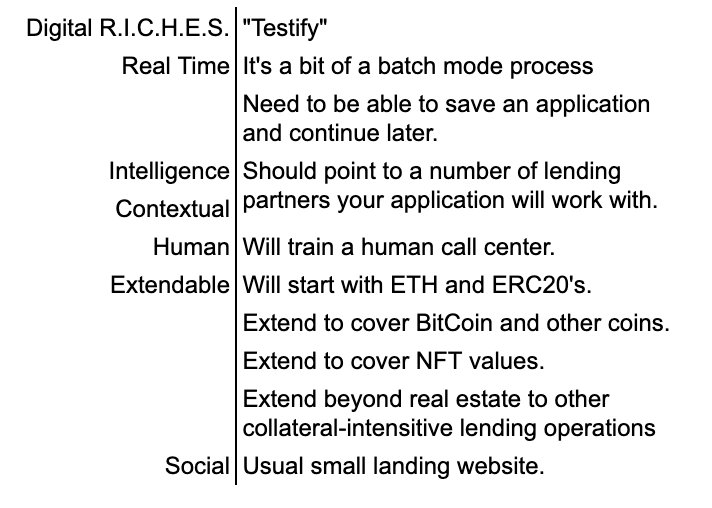

Continuing on with my “Testify” idea to KYT crypto for real estate use in the US.

This is just a tribute, to the greatest business plan ever written. The greatest business plan ever written reads nothing like this R.I.C.H.E.S. form…

R: The full cycle of carbon credit confirmation, issuance, exchange and settlement can be done in one block smart contract. Hence the activity tracking and transacting is as realtime as can be.

I: Intelegence of price monitoring and automated market making to make sure that both the buyer and the seller get the best price possible.

C: The app is focused on direct related participants only to make the market fair and free of speculation and hoarding. Hence it includes only carbon credit generators and emitter’s accounts .

H: The human factor will be there to support the buyers and the sellers in their needs.l. the sellers require maintenance on site to ensure the effective function of the devices there and the buyers require the marketplace to be secure and operational 24/7.

Extendable; The app is extendable to be interlinked via API with other financial service providers based on the clients requirements.

Social: The green economy is looking for applications that encourage the effective use of carbon credits and having a realtime application that can turn the credit production into cash instantly helps grow that economy and the confidence in it.

Go through the points of the digital R.I.C.H.E.S with your business case in mind and write down what you would do in order to fulfill all parts of the framework.

Real Time

All NFT’s owned will be viewable and marketable within the app, crosschain marketplace to buy and trade

Intelligence

Collating and displaying crosschain data and use of NFTs

Contextual

Statistics and rarity of the NFT, rankings, price action and viewing in one slick experience for holders and new users

Human

Users can browse outside of membership or join to create wallet and start trading or linking you current NFTs to 1 location

Extendable

Scaleable to new networks and protocols over time

Social

Community benefits and level ups, rankings and voting rights, social sites and member chat and support areas… maybe metaverse reception???

R: All Transaction will be approved on the Terra/Luna Chain

I: Give to the firms data on where the customers are more willing to invest their money

C: Analytics on customers demands and trends od demand

H: Partner firms would take care o customer interaction

E: Scalability

S: Build a strong community to make the project grow

I’m not in the process of building a Fintech company or have any plans to do so. My whole purpose of going through this course is to get a solid understanding of Fintech so I can join the industry and continue to learn and grow from there. The materials provided are great references in case I change course down the line and decide to create my own Fintech.