is the last video of the defi course not working ???

Yes, we could create an additional layer of abstraction with futures, options, and other innovative financial instruments. However, my concern is about creating too many layers of abstraction, leading to a repeat of the 2008 mortgage bubble crash. How do folks think we can protect this DeFi ecosystem from a collapse due to too many layers of abstraction?

Works for me

Please try again let me know if you still have issues.

Really easy to do! I like how I can over collateralize my position on compound to maintain it through higher volatility in Ethereum.

I think its a great way to save and earn interest on funds that you would use to stat a business. its Funds that can be used in the future while helping to build the community in its early stages

It’s all very cool… I will likely have a lot more to say in a month, after the haze clears and I get a comfort level actually utilizing and managing assets with these tools.

However, the first thing practical thing I might try is to create leverage. That is, I have a long term (daily) technical trading set up. So when I see signals for a fall in ETH, I convert my ETH to DAI so I can buy back into ETH when the price has fallen to the point I detect it will reverse.

Now, I can do 2 things from what I learned here:

1 - Do this conversion using Metamask and any one of many protocols,

AND!!

2 - When I feel the price is turning back to an uptrend and I want to buy back into ETH, after doing so, I can lend myself DAI from my ETH, and then buy more ETH, and gain some leverage…

Of course there is trouble brewing here if my set-up/signal is wrong, but that is true in any leveraged trading scenario…

I’m definitely going to try this soon to see how it plays out with nominal amounts of ETH, but I can see this as something I might do regularly.

Furthermore, I love making the ETH/DAI exchanges on a trustless protocol instead of a centralized exchange that will track me and create intermittent tax consequences.

been using aave a decent bit as well as compound. Been depositing DAI then taking out LEND at 0.01% interest, converting it to DAI and re depositing it to leverage my savings but it seems like it working the opposite way, not sure why, tho I suspect its due to price changes in the markets.

Good idea but using CeFi is a bit easier but doing on Defi is a bit chalenging especially if cannot connect the metamask to uniswap and other defi applications. Is it the Bat browser a problem?

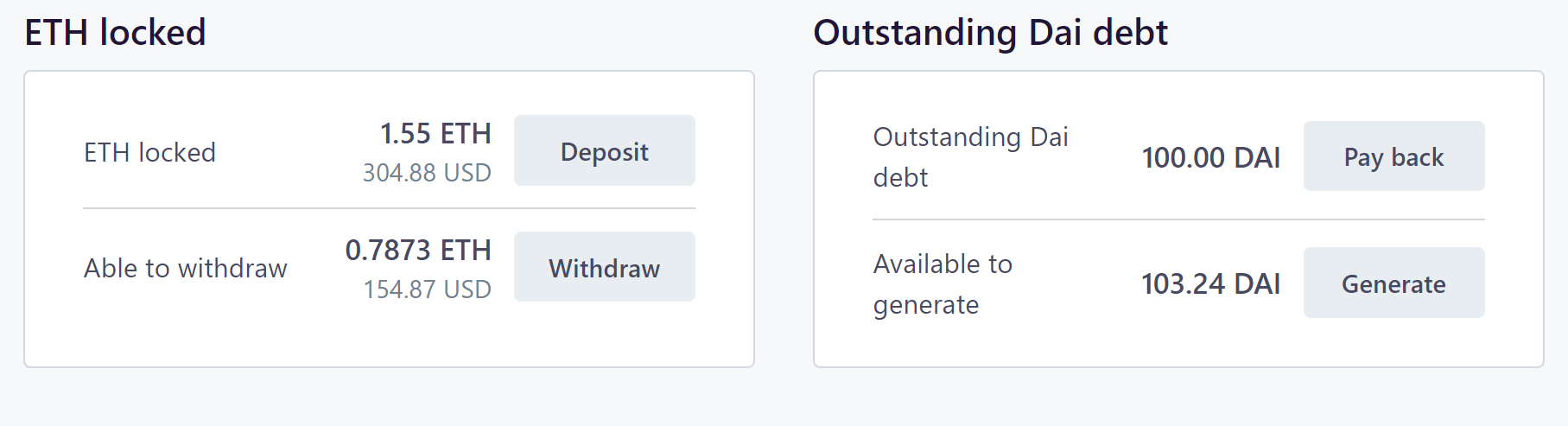

This has been fun. I opened a maker CDP with 1 ETH and and minted 75 DAI tokens. At the current ETH price of $195 this gives me a collateralization ratio of 259% and liquidation price of $112.50. I then parked these DAI tokens in the Celsius Network (I know this is not technically DeFi) as I can earn 7% here compared to the DeFi protocols mentioned above which are around 0%.

The only issue I am having is that have multiple MetaMask addresses in my wallet and it seems that i cannot switch between addresses on compound, Oasis, or any of these other DeFi apps. One address is connected through Metamask using a LedgerNanoX hardware wallet and, on top of the problem just mentioned, it keeps allowing me to approve a transaction but it will not go through. It will eventually show up as failed because the ‘Approve’ signature does not pop up on my Ledger. I am able to transact perfectly fine with the LedgerX using Ledger Live so it seems to be a Metamask issue. Anyone know what might be causing this?

I am so lost. I feel overwhelmed. trying to do this assignment using kovan. got to the point where it is telling me I have my limit of eth. yet my meta mask wallet shows a balance of 0?i’ve been working on this part for hours

Sounds to me like it says zero because the eth has been locked. This is good. It’s not spent. Its saved.

I need help…where do I get it. I am trying to do the assignment where you navigate in DeFi. One option was through kovan. Which I am attempting with little success. I am a tecy dumass. Can you help me?

Hmmm…

I use trust wallet + metamask I work on desktop and mobile (built in web 3.0 fo tha win!) Screenshots taken from trust wallet this morning on phone so please excuse sizes and odd cropping tablet is charging…anyway

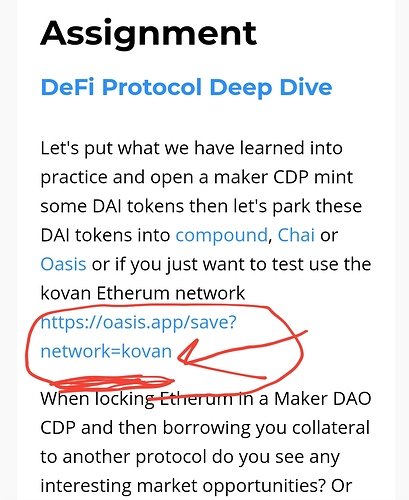

1st things 1st kovan likes the oasis dapp. Thats your portal. Follow the last link on the defi deep dive instructions

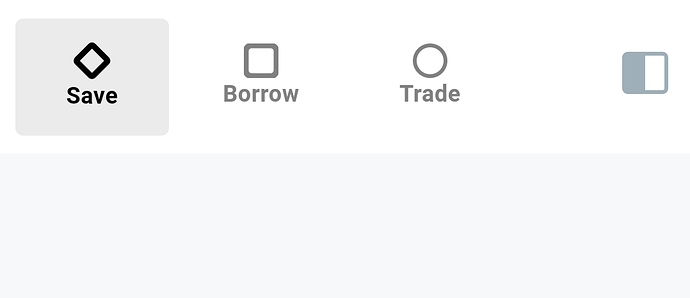

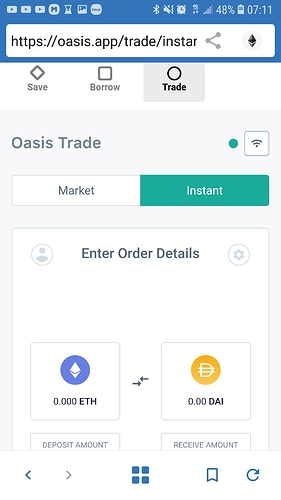

Now at the top of the screen you should see this

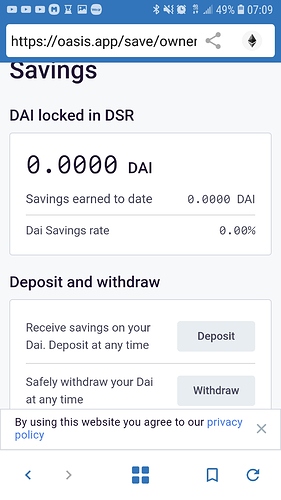

It will ask you to link your wallet if you have not already. Then Tap/click Save and you should see this screen

Your wallet should already have access so the funds will be there…if you have dai. Waite no dai? But you got eth? Hit trade at the top and go here. Now swop it for some dai…or whatever

Boom! Head back to save and deposit that dai like a financial boss.

Note:

Once you integrate your wallet your funds will move, sometimes seemingly disappear but it’s not gone. The funds are interacting with the contract/s. I had this scare myself working with maker cdps. The eth went to zero! Buuuut it was just locked in my vault and as such does not show up in “regular” wallet view but does in my maker vault. From a traditional fiat stand pont Think actual funds vs available funds in your checking.

Stay focused remain diligent and stack those SATS!

Teamwork makes the dream work

Fresh OUT

PS…this help is greatly appreciated

I think I have some DAI …I think I tried to send it to oasis for savings? I really don’t know what I am doing. it asked my metamask to confirm the transaction. I don’t know where the DAI is stored. In oasta is or on metamask? I can’t believe I am getting

anywhere. it seems to be slowly moving along . very slowly. yet I really do not have an idea about what or how it’s going on?

Sounds like some progress was made!

Go back to the save option of the app and see if you have the ability to deposit. (Top left)

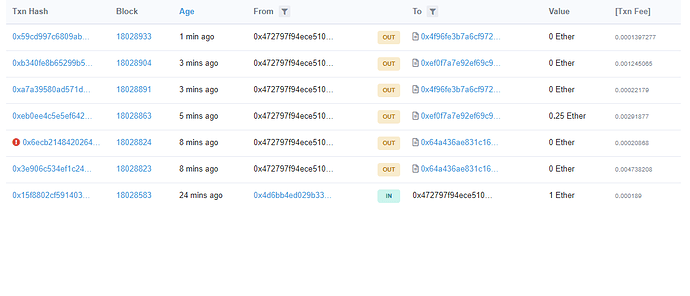

Another Avenue is to look up the transaction on ether scan (assuming you have the hash ofcourse )

Hi everyone,

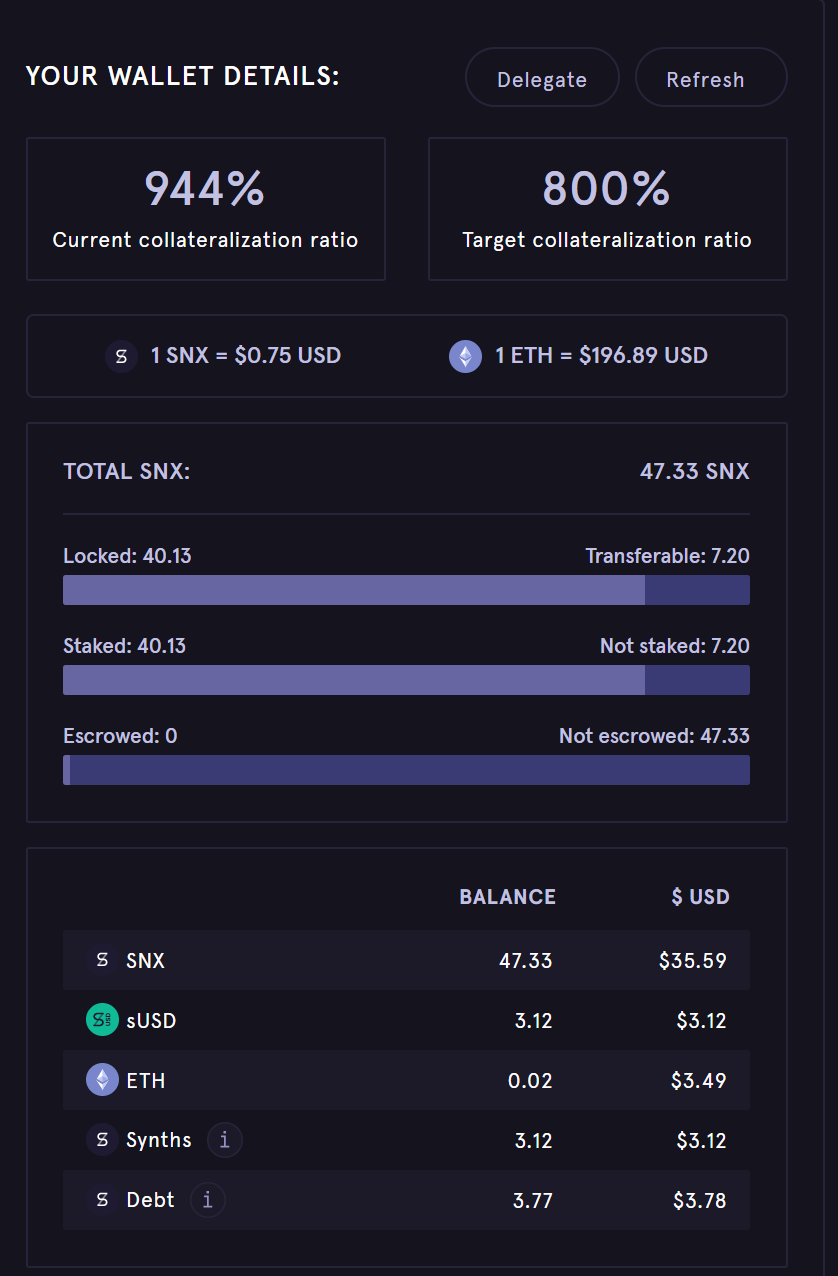

I take the first steps and make my CDP, the generated DAI, after using compound to lending , I decided to converted on uniswap for sUSD to lending on Aave . I also start to locked SNX on Mint! so far so good… In other words, I’m loving this experimental!

I decided to use a testnet because I lost already too many real tokens trading…

Sorry to use the forum as notepad to report step by step my first time in defi…

I created a GitHub account, switched Metamask to the Kovan blockchain used the https://faucet.kovan.network/ giving my address in that test network,

in https://oasis.app/?network=kovan connected the MM wallet, clicked start, deployed proxy (spending 0.009476 kETH), allowed Oasis to manage my kDAI (0.0011 kETH). Clicked borrow, get-started to open your first Vault to start generating Dai, selected ETH-A as collateral, Depositing

0.97 ETH, Generating 56.15 DAI, Collateralization Ratio 228.16%, Liquidation Ratio 150.00%, Liquidation Price $86.82, Liquidation Fee 13.00%, Stability Fee, 4.00%.

Clicked open-vault, confirmed on MM AMOUNT + GAS FEE 0.986637 and with the transation:

https://kovan.etherscan.io/tx/0x22e7eef8c393313d1fa70348bc7b1e70af0b853e9e5385f710195a9b16b629f4

56.150 DAI appeared in MM.

I also traded 1/2 of my kovan ETH that i do have for DAI. do not know where that went … it’s not in my metamask? I did see it somewhere last night. I have a friend that is good with computers etc supposedly coming over soon. It will take me forever to

finish there courses if I have to do this a lot. I have been on this one segment for I think a week come tomorrow. every day. so frustrating. appreciating your help. thank you