A little early for me to give any Yield Hacking strategies but gaining interest on certain defi and cefi platforms like compound, Aave, Nuo, etc. is better than any centralize bank hands down. Now that i have taking this course i will try some liquidity pools and flash loans. As for now cefi and Nuo gives me good ROI as i known its more of a risk but so far so good. I do think that the gas prices of transaction cost keep many newby’s from investing in some of these ventures.

The main difference between now and the next wave of finance is the future transparency blockchain offers within accounting. So although whales may get in early and make the first huge gains, the way in which they manage their capital going forward will be much more open to scrutiny and will prevent much of the corruption that feeds the ongoing wealth divide. In the end people who add value should be able to transfer wealth away from idle fat cats.

So here’s a potential strategy:

- Use ETH to collateralise Dai on Maker (going long eth) https://oasis.app/borrow

- Use 1inch to swap Dai to sBTC https://1inch.exchange/#/DAI/sBTC

- Deposit sBTC in Curve and receive Curve LP tokens https://www.curve.fi/sbtc

- Stake Curve LP reward tokens using Mintr to gain CRV and BAL tokens. Also BPT tokens (the LP token) will accrue and can be unstaked at any time which will be converted to into SNX and REN https://mintr.synthetix.io/

This would be a leveraged strategy that could only be liquidated by a large drop in Eth price, however its also leveraged against the price of BTC since sBTC in the chain.

I’m not sure how to calculate if this strategy would be worth the risk however it sounds like a lot of upside. The best way to mitigate the risk is to have a very highly collateralised ETH to Dai loan. Possibly covering a drop to $100 for Eth.

Would love to hear anyones thoughts on this

Cool this makes a lot of sense.

We should have a website where we can share and compet these strategies.

The backtesting and modeling of these strategies is still a bit hard I’m looking into open sourcing some of the models I use for this. Issue rmains that this is indeed high risk but also good return …

If ETH does not drop below $100 you will get ± %20 APY + LONG ETH + LONG BTC

I like this setup.

We can make this into a solid strategy and propose this to PIE DAO for example if interested.

Cool let me know if you need help I’m in governance board

So we can make strategy and offer this to Arragon

A variation to this strategy would be with a bit more security:

It is a good idea from here next step is:

- Instrument listing

- Data input lists (ETH price, BTC Price … etc)

- Model end rules (IF ETH >100 then increase collateral and rebalance SNX, BALL)

- Backtesting

Then see how much you want to risk for how long?

Would recommend: https://www.uniswaproi.com/ or https://www.zapper.fi/ to keep track.

Would maybe start with a bit less risk like:

- Use ETH to collateralize Dai on Maker (going long eth) https://defisaver.com/ auto secure your vault to always have %210

- Use 1inch to swap with DAI into https://www.curve.fi/susdv2/ (Also activate CHI tokens)

This is a bit safer would start here and then explore more check also:

I Will published some more strategies soon.

Thanks @amadeobrands the https://defisaver.com looks really cool for protecting your loan with it’s automatic collateral top-up feature.

I’ve decided to go for the strategy partly because I really want to start accumulating all the reward tokens SNX, REN, BAL & CRV.

I’ll add protection to the loan by enabling the feature from defisaver.com and leaving some space eth in the account for it to draw upon.

I know I shouldn’t rush into these things but I find it’s the quickest way to learn by putting some real money on the line

I’m also using zapper.fi to view the status of the investment which is a really nice touch.

Having looked at the curated list of strategies in the Tier List link you shared one that seems like a safe win is the mStable/USDc one: https://tokenbrice.xyz/posts/2020/yield-farmer-tier-list/#contents:the-50-musd--50-usdc-balancer-pool. Since it’s using all stable coins for the input and still generates BAL and MTA tokens it seems like a safe place to park some of your disposable monthly income maybe (without the worry of the underlying asset changing price) - as long as the profit exceeds the tx fees.

I just found an article that speaks about ‘initial defi offerings’ here https://defiprime.com/initial-defi-offering

It talks about some of the recent governance tokens from protocols like compound and balancer but also provides release dates for BZRX / box (July 13th) and MTA / mStable coins (15th June).

It also explains some yielding strategy so worth a read

@amadeobrands hi amadeo thanks for your videos I have a question about starting a hedge fund as a business in the space with 500k investment at the beginning and I have no coding experience how do you suggest I start it and start growing the amount invested?

And I haven’t checked actual active hedge funds in the space could you please guide me what do you think it is that differentiates the good hedge funds and what are some things I can do to grow big?

Hi

I am looking at arbitrage ideas and think that many of them that existed early on will be hard to implement however there should still be some ongoing opportunities if we look hard enough. When there is a dual coin, a utility and an exchange coin that are a pair there will be arbitrage often. The companies or exchanges that setup this kind of system know that the market will correct the spread. This is one of our opportunities to take advantage of. I am just outlining some code structure for this and hope the rest of the course will help with it.

I also think there will be opportunities between Defi and exchanges like Binance where you can take advantage of spread differences but I need to play a bit more with their API to see if I can make it work the way I intend.

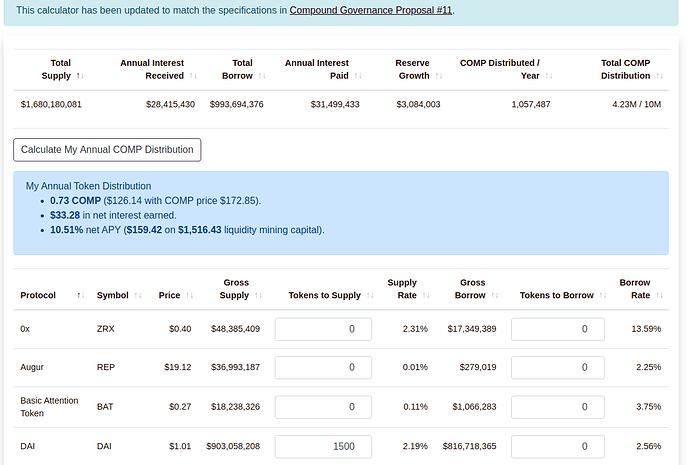

i found a save ‘bet’ to make use of the compond protocol and earn 10.5%.

i calculated the rewards by providing DAI as stablecoin, the rewards are 0.73 COMP tokens by using the protocol as calculated on www.predictions.exchange

The risk a very low because you are not lending.

second step is to lend again DAI and create a savings account on Aave

Rates for DAI on AAve are :

As long as 6.5% is more then you lend DAI it is a extra profit.

So concluding this strategy will do around 13…15% with a low risk profile.

Super cool but remember every % gain comes with a risk …

The reason I’m in crylpto. Is because I did not knew how to use finances, so do concepts are not familiar to me. But I’m learning.

@amadeobrands

I heard about Ampleforth from Good Morning Crypto and did some research myself and came across ampleforth.org/geyser

I believe this is the best bang for the buck yield attaining at this moment in time and possibly for the next month.

For providing liquidity to the ETH/AMPL pool, you are given the highest reward rate on uniswap at the moment. Additionally you are giving UNIv2-WETHAMPL tokens that can be placed in ampleforth.org/geyser for added returns at insane interest rate.

Not necessarily yield hacking but I think strategies in the space will fluctuate so much given the amount of development coming into the space.

Yeah im interested to hear amadeos thoughts as well. Is it too risky in your opinion? From my research ample seems pretty legit, rebase is mind blowing haha

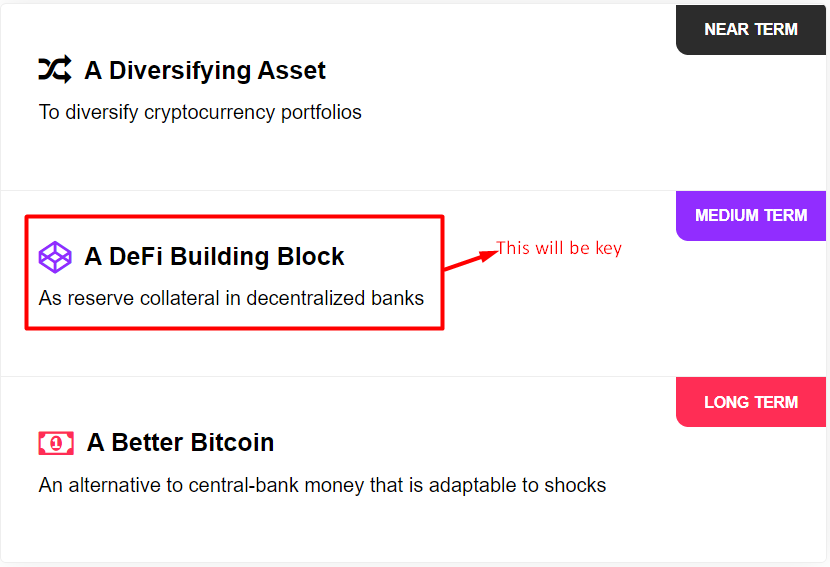

As far as Ampleforth is concerned, I am not so sold on their narrative. I believe their claim is that they are “Bitcoin 2.0” and a better currency distribution system. To me it is not bitcoin in the sense that it is still centralized, doesn’t have the massive network etc. but its properties are super fascinating to say the least. I have put like 0.5% of my portfolio into it, but it’s been mooning recently. I used the profits to contribute to the uniswap liquidity pool and I am just going to hodl from here on. But bigger risks = bigger rewards and if any promising news comes in I might diversify more into AMPL. Since we are more active in this space we are most likely to hear AMPL news sooner than the others in the crypto space and we can still get a lot of profits even then. At the moment I still feel like it is too risky but looking at their roadmap:

I feel like the part where they become collateral on Defi, if that happens, this will be super exciting and I will definitely invest like 10% or more into it. But at the moment I will just keep a close watch.

Definitely interested in @amadeobrands thoughts

Ampleforth {AMPL} is very interesting indeed.

It is a monetary experiment but it is still a clear capital asset and I think it is good to hold some at this point especially when the team is still locked in there AMPL tokens. Long term I feel there is a %chance that they will succeed to become collateral but that change is a bit small.

Overall I feel a bit said since people tend to just forget about why we all do this …

But yes gains are great but progress is better and will give more long term gains.

I feel we need to focus more on projects like https://centrifuge.io/ and try to build real live use cases.

As of now I also do hold some AMPL but also looking a bit at it but mostly keeping it.

It gives me the joy to see people trying to think a bit deeper of what this can be used for the community at this point feel very 2017 and I hope we can go back more to the fundamentals.

I’m with you on this one, unfortunately  .

.

Hey guys,

question regarding a geyser. I am in phase of playing a bit with Ampl and it puzzles me. Everyone says - lock it in geyser to get some yield. But I get quite a lot of new AMPLs by just sitting in my wallet (app wallet). Should I do Geyser instead… is the amount of new AMPLs greater there? What is the advantages in comparison to holding in wallet?

just to give an idea… each 24h I get around 10% more of new AMPLs.

thanks