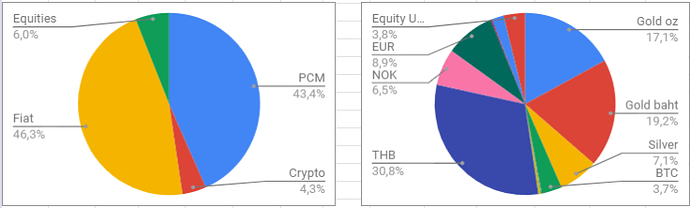

This is my spreadsheet for a full overview as of today:

FAR too heavy on fiat right now, a lot of that is cash too - will convert more to gold the next days, super-easy here in Thailand

Got started with crypto and using fintech like Revolut a couple of years ago, the way I see it having “channels” and ways of moving money around can become VERY important very soon!

Will normally also be around 10% in crypto, now doing the DeFi-course & will look into spreading a little around on different platforms for lending ++

Setting up a full spreadsheet on all resources is a good thing in my mind, this is something I spend time doing at intervals - next step with this one is a pie chart that shows me how many percents of my assets are liberated money and what is still caught in the fiat insanity

Costs here can be super low, today I had lunch for less than a dollar, spent around 10 on some stuff at 7-11 and other than that maybe 50 cents on gas for the motorbike. Could even pull it down even lower!

The one big thing here is visa an work permit, so far so good - and getting the certifications in the academy will help my status as an IT expert here